The financial markets witnessed many developments during the trading week ending on Friday, July 5, 2024, in terms of major currencies, American and international stocks, commodities, and other most prominent traded assets, and in this weekly report we attempt to monitor the most important developments.

Markets were mixed this week, with some sectors benefiting from potential changes in US, European and Japanese monetary policy while others reacted to geopolitical events and investors are closely monitoring economic data, especially labor market trends, to gauge the Federal Reserve’s monetary policy decisions.

Energy

Energy markets were able to offset the impact of Hurricane Beryl on the Gulf of Mexico with a rebound in potential ceasefire talks in the Middle East, which led to increased oil supplies from the Middle East.

Despite the turmoil, WTI prices rose for the fourth straight week, rising 2.1% to close at $83.16 a barrel and natural gas prices also fell sharply, with Henry Hub futures falling 12.3 cents to open the week and ending 10 cents lower at $2.319. per cubic foot.

The US economy and the dollar:

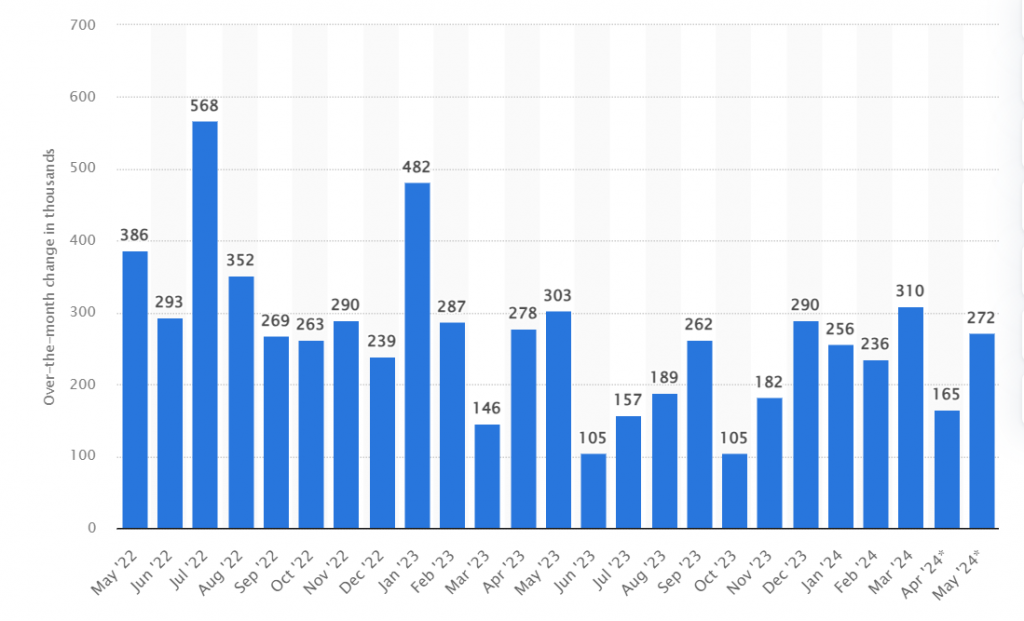

US job growth slowed in June, with nonfarm payrolls increasing by 206,000, above expectations of just 190,000, and revisions to data for May revealed a significant downward revision.

The US unemployment rate rose slightly to 4.1%, prompting investors to speculate on a sooner-than-expected interest rate cut by the Federal Reserve and the US dollar index fell on jobs data, declining to its lowest levels in three weeks.

Futures markets now expect a 72% chance of a rate cut in September, up from 57.9% the previous week. The euro rose against the dollar, on its way to achieving its largest weekly gains of the year.

Gold prices:

Gold prices surged more than 1% to a six-week high of $2,385 on the back of mixed US jobs data and speculation of an imminent interest rate cut from the Federal Reserve. A weak dollar and lower Treasury yields contributed to the rise in gold prices.

Stock market:

The S&P 500 hit record highs despite lower trading volumes due to the Independence Day holiday and growth stocks significantly outperformed value stocks, likely due to expectations of lower interest rates, and the Dow Jones Industrial Average fell behind the S&P 500.

Economic data and statements by Jerome Powell, Lagarde

Manufacturing and construction activity contracted in June, raising concerns about US economic growth, and the services sector also revealed signs of weakness, although surveys vary in the extent of the slowdown. Labor market data confirmed a slowdown in job growth, with some sectors such as hospitality showing striking weakness and the unemployment rate rising. Wage inflation declines, which may influence the Fed’s decision-making process.

Fed Chairman Powell’s comments indicating a slower path toward inflation targets boosted expectations for a rate cut and Powell’s comments and this week’s economic data appear to have led to a decline in long-term US Treasury yields during the week (bond prices and yields move in opposite directions).

As for European Central Bank President Christine Lagarde, she seemed somewhat optimistic. At the ECB’s annual forum in Portugal, Lagarde struck a more hawkish tone, saying Europe faces uncertainty about future inflation, especially in the development of profits, wages and productivity.

Lagarde also added that it will take time to collect enough data to determine whether the risks of over-target inflation have been overcome. Minutes from the ECB’s June meeting showed that some members had opposed rate cuts since 2019, citing firmer wage growth and inflation. The final Eurozone inflation estimate confirmed that the year-on-year change in consumer prices fell to 2.5%, and the German manufacturing sector also saw further weakness in May, with seasonally adjusted orders falling by 1.6% sequentially and industrial production shrinking by 2.5%.

Activity in the overall bond market was generally light during the holiday week.

Europe

The STOXX Europe 600 index closed up 1.01 percent and political tensions eased with the far right in France failing to win an outright majority in the first round of legislative elections on June 30. Meanwhile, the Labor Party won the general election in the United Kingdom on July 4 with a large majority. Under the leadership of Sir Keir Starmer, the Labour Party achieved a resounding victory, ending the turbulent Conservative rule that lasted 14 years, and Rachel Reeves is scheduled to take over as the country’s Finance Minister.

Major stock indices rose, with France’s CAC 40 rising 2.62%, Germany’s DAX rising 1.32%, and Italy’s FTSE MIB rising 2.51%. The British FTSE 100 index rose by 0.49%.

FOMC Minutes

Financial market reactions varied to the results of the Federal Reserve meeting, as the US dollar declined against a basket of major currencies, continuing the decline it had begun at the beginning of trading on Wednesday.

The Dow Jones Industrial Average fell to 39,308 points after losing about 55 points, or 0.2%. But the Standard & Poor’s 500 rose to 5,537 points after gaining about 13 points, or 0.3%. The Nasdaq Heavy Technology Industries also rose to 18,188 points after adding about 83 points, or 0.5%.

Ten-year US Treasury bond yields fell to 4.364%, compared to the last daily close, which recorded 4.437%. Returns rose to their lowest level on Wednesday at 4.448%, compared to the lowest level recorded at 4.341%.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations