Global financial markets concluded the first trading day of the new week under the sway of mounting geopolitical tensions in the Middle East, which dampened risk appetite. This led to a decline in several risky assets by the end of Monday’s trading session. However, another factor intervened to balance investor sentiment: anticipation of the Federal Reserve’s decisions. These decisions, scheduled to be announced following the conclusion of its meeting on Tuesday and Wednesday, could potentially shift the course of current monetary policy.

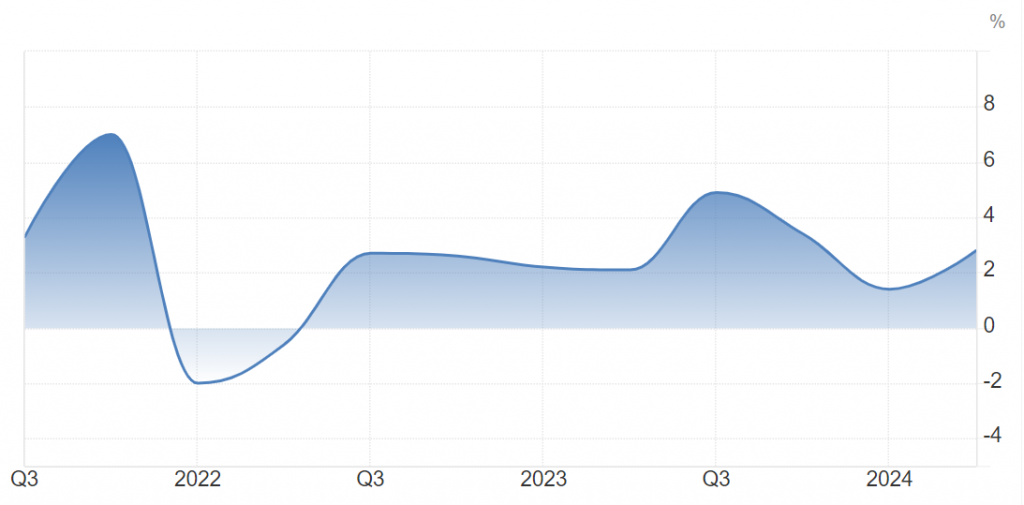

US inflation data released late last week confirmed that price growth in the United States has continued to decelerate over recent months. This bolsters the likelihood of an imminent Federal Reserve interest rate cut—potentially as soon as the September meeting, according to the most widely held market forecasts. Such a decline in inflation would provide the Federal Open Market Committee with greater leeway to initiate interest rate reductions, assuring that inflation is on track to meet the central bank’s target of 2.00%.

Indeed, the United States has recently experienced a decline in inflation rates across all levels and price components. This is evident in the economic data, which is considered the most credible and reliable indicator of price growth in the country by the Federal Reserve.

Regarding the central bank’s second primary objective, the labor market continues to exhibit mixed performance, with both improvements and deteriorations. The Fed needs to see a slowdown in job and wage growth in the coming period to effectively control inflation rates. This underscores the need to await the upcoming US employment data, which could be instrumental in determining the timing of an interest rate cut, whether in September or at a later meeting.

Economic Data

The Personal Consumption Expenditures (PCE) index, considered one of the most reliable and credible indicators of inflation in the US by the Fed, increased by 0.2% on a monthly basis in June, compared to the previous month’s larger increase of 0.4%. This was below market expectations, which had pointed to a potential unchanged reading.

Additionally, the annual reading of the PCE index in the United States increased by 2.5% in June compared to the same month last year, which recorded a higher increase of 2.6%. These figures were in line with market expectations.

The US employment data, to be released next week, is eagerly awaited due to its significance in revealing the state of the US labor market. The trends in job and wage growth will influence the Fed’s decision, with two possible outcomes: a rate cut if employment data deteriorates further, or maintaining current interest rate levels if the data improves.

Geopolitical Tensions

US stocks exhibited mixed performance at the start of trading on Monday amid escalating tensions in the Middle East and an Israeli airstrike on Gaza that resulted in the deaths of several Palestinians in the territory. Additionally, markets are awaiting the Federal Reserve’s decisions on Wednesday following the conclusion of its July meeting, creating a conflicting and contradictory dynamic among market-driving factors.

The US dollar began the new week on an upward trajectory, bolstered by the escalating tensions in the Middle East and Israel’s airstrikes on several areas in Gaza, which led to a high number of Palestinian casualties.

The dollar index, which measures the US currency’s performance against a basket of major currencies, rose to 104.57 points compared to the previous day’s close of 104.32 points. The index reached a low of 104.14 points during Monday’s trading and a high of 104.75 points.

Concerns over the widening scope of geopolitical tensions in the region overshadowed hopes that the Fed might adopt a more dovish tone in September, providing significant support for the US dollar throughout the first trading day of the new week.

The US dollar experienced no significant change last week compared to the previous week due to various competing factors influencing the currency. These factors ranged from economic data, most notably inflation figures, to political factors related to the US political landscape ahead of the 2024 presidential election and its impact on the oil-rich Middle East, a region of strategic importance to major global powers. Additionally, geopolitical tensions in the region, particularly the ongoing conflict in Gaza, played a role.

Market participants are bracing themselves for a week packed with significant events that could significantly impact financial markets. Most notably, the US Treasury Department announced its borrowing needs for the upcoming quarter at $740 billion, lower than the previously anticipated $847 billion for the July-September period.

The Federal Reserve meeting, scheduled for Tuesday and Wednesday of this week, tops the list of important events that will shape the trajectory of global financial markets. We may begin to see the impact of the Fed meeting on markets from the early hours of Monday’s trading, given the heightened anticipation regarding the central bank’s decisions and the potential messages that its chairman, Jerome Powell, will convey.

The Fed meeting comes amid widespread expectations that the central bank will keep interest rates unchanged at the current range of 5.25% to 5.50% in its July meeting. Most market participants believe that the Federal Open Market Committee may not adjust interest rates until its September meeting.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations