Markets kicked off last week on a cautious note after President Donald Trump announced late Friday a 100% tariff on Chinese imports.

By week’s end, Trump had softened his stance, calling the current tariffs on China “unsustainable” and confirming plans to meet with Chinese President Xi Jinping later this month — a move that helped ease trade tensions between the two nations.

These tensions were a key driver behind the dollar’s weekly decline.

Government Shutdown

The ongoing partial shutdown of the U.S. government continues to pressure the dollar. The longer it drags on, the greater the risk to the economy — and that’s reflected in the currency’s performance.

Last week brought more setbacks, dimming hopes for a resolution to the political standoff between Republicans and Democrats that sparked the shutdown in the first place.

The Senate failed for the eighth time to pass a House-approved bill to fund the government and end the impasse.

On Thursday, the Senate rejected a Republican-backed proposal to reopen the government for the tenth time, falling short of the 60 votes needed to advance — a clear sign that negotiations remain deadlocked. The final vote was 51 to 45, below the required threshold.

Fed Officials Signal More Easing

Comments from Federal Reserve officials leaned toward further monetary easing, with expectations building for rate cuts in upcoming Federal Open Market Committee (FOMC) meetings.

Richmond Fed President Tom Barkin said USproductivity is improving, which could help offset inflationary pressures from trade tariffs.

The dollar also reacted to dovish remarks from Boston Fed President Susan Collins, who reinforced expectations for a rate cut at the FOMC’s October 28–29 meeting.

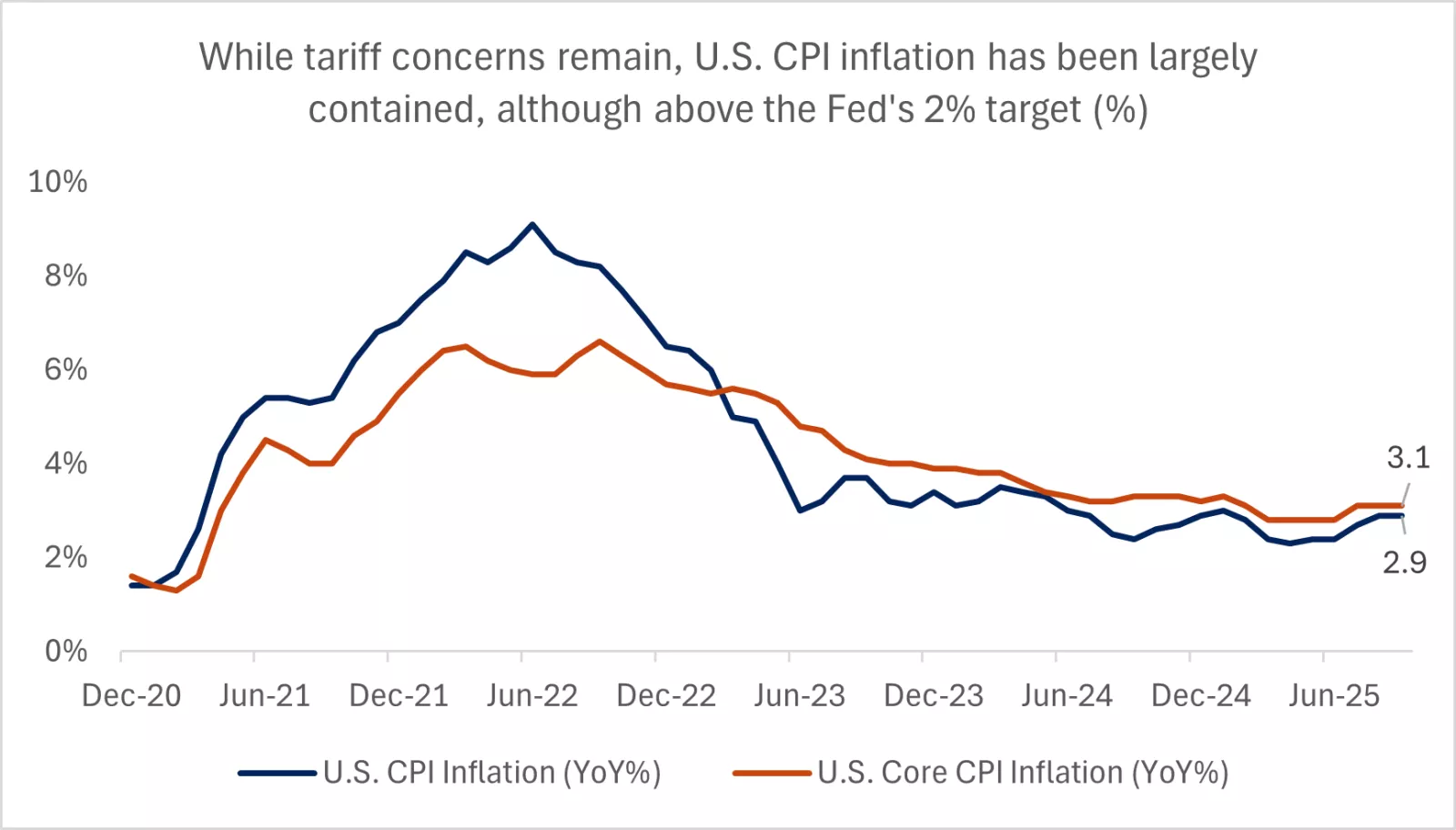

Collins said it would be “wise for the Fed to continue cutting rates this year,” noting that inflation risks are now more contained while threats to the labor market have grown.

Gold Surges Relentlessly

Gold continued its record-breaking rally last week, driven by a combination of market factors.

Government Shutdown The prolonged partial shutdown in the U.S.—one of the longest in federal history—added upward pressure on gold prices.

Central Bank Purchases Global central banks, led by the People’s Bank of China, have been steadily increasing their gold reserves.

ETF Holdings Holdings in gold-backed exchange-traded funds (ETFs) surged to their highest level in three years, reflecting strong investor demand.

Political Unrest in France and Japan Ongoing political crises in major economies, particularly in France and Japan, have boosted gold’s safe-haven appeal.

Fed Signals More Rate Cuts Statements from Federal Reserve officials suggest growing consensus within the FOMC that the U.S. economy needs further monetary easing through interest rate cuts.

By the end of last week, gold had climbed above $4,200 per ounce.

Japanese Yen Gains Support from monetary policy rhetoric

The Japanese yen saw notable support over the past week, bolstered by multiple factors—chief among them, the Bank of Japan (BOJ) and the Ministry of Finance.

Japanese Finance Minister Shunichi Kato helped lift the currency with remarks signaling potential intervention. He stated the government would “closely monitor” any excessive or disorderly movements in the currency market, hinting at possible official action to stabilize the yen.

BOJ board member Naoki Tamura also called for interest rate hikes to counter rising inflation risks. “I believe the Bank of Japan has now entered the phase of deciding on a policy rate hike,” Tamura said, noting that the weak yen is amplifying inflationary pressures and that current rates remain well below the neutral level needed for monetary balance.

Despite these supportive signals, the yen’s gains remained limited due to domestic political and economic uncertainties.

One key factor was the unexpected election of Sanae Takaichi as leader of the ruling Liberal Democratic Party, positioning her as the frontrunner to become Japan’s next prime minister. Her victory raised concerns that the BOJ may delay tightening monetary policy, as Takaichi supports expanded fiscal stimulus—potentially increasing the supply of government debt.

In another political development, Japan’s ruling coalition fractured after talks between Takaichi and Komeito Party leader Natsuo Saito failed to reach an agreement. The collapse of the alliance complicates the passage of the national budget and other key legislation, raising the possibility of early elections.

Meanwhile, escalating U.S.–China trade tensions and falling U.S. Treasury yields added further support to the yen, reinforcing its appeal as a safe-haven currency.

What’s Behind the Euro’s Weekly Gains?

The euro rallied last week amid growing optimism over concessions made by French Prime Minister Sébastien Lecornu in the draft budget, which could help him secure its approval and avoid a scheduled no-confidence vote on Thursday.

Lecornu’s government survived a second consecutive no-confidence vote last Thursday, restoring a measure of political stability in France and positively impacting the euro’s performance.

EU Monetary Policy

European Central Bank President Christine Lagarde expressed confidence in the eurozone’s economic outlook, boosting the euro’s appeal as a risk asset favoured in optimistic market conditions.

Lagarde stated that the eurozone economy is “in good shape,” prompting investors to unwind short positions and support the single currency. Also on the monetary front, Governing Council member Gabriel Makhlouf voiced concern that inflation could exceed the ECB’s 2.00% target.

Meanwhile, Bojan Dolenec noted that current policy is not fueling inflationary pressures, nor is it hindering economic activity—suggesting no need to adjust interest rates for now or in the coming months.

EU Data

In Germany, September data showed wholesale prices rising by 1.2% year-over-year—the fastest pace in six months—indicating a modest pickup in commercial activity within Europe’s largest economy.

The euro also drew support from Germany’s ZEW economic sentiment survey for October, which rose by two points to 39.3, signalling improved growth expectations.

U.S. Stocks challenge lingering negativity

U.S. equities closed last week with notable gains, though several negative factors limited the upside across Wall Street and other global markets.

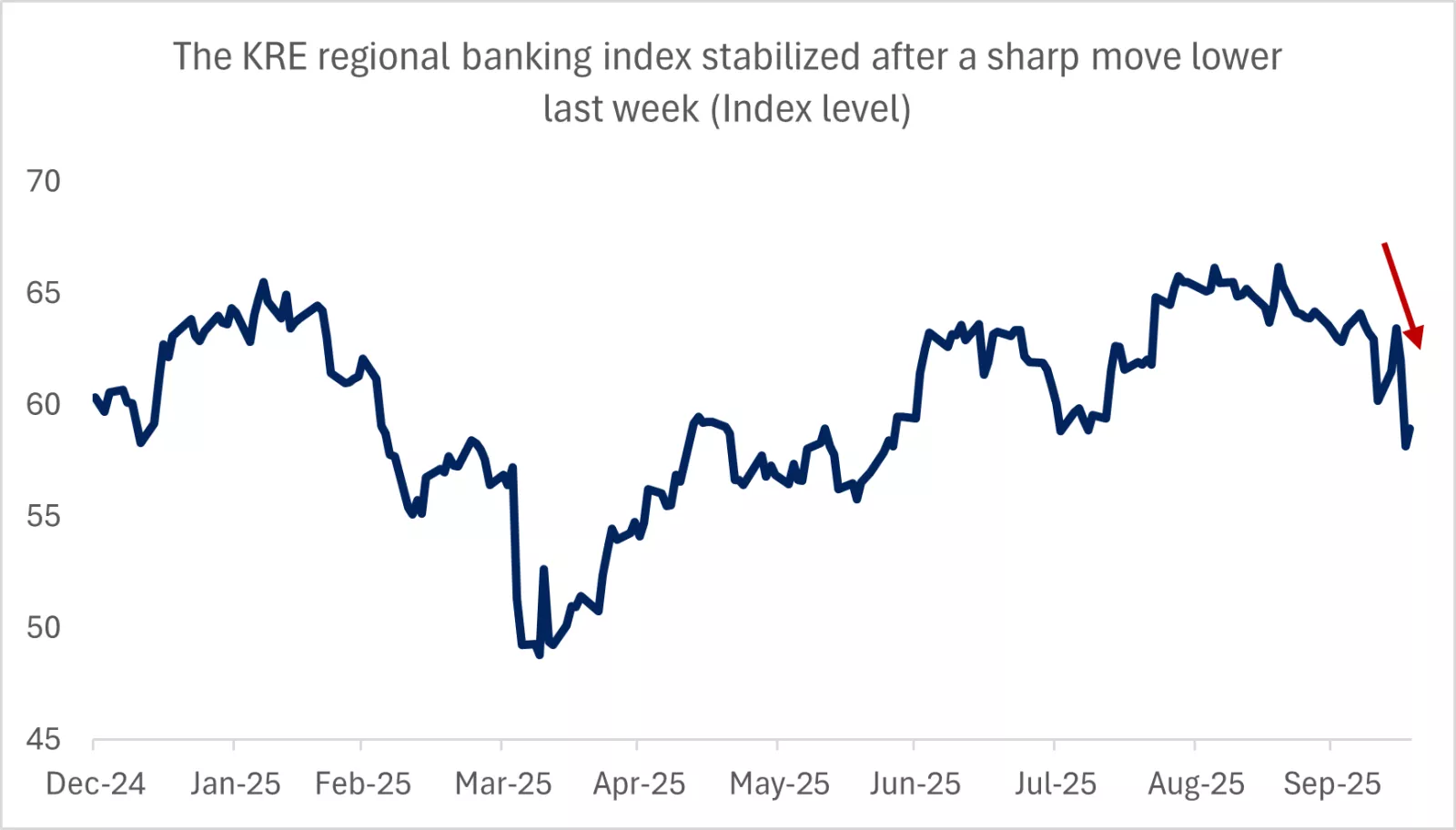

Regional Bank Concerns Investor worries over credit quality at smaller regional banks in the U.S. weighed on stock performance. Reports of fraud at institutions like Zions Bancorp and Western Alliance Bancorp added pressure to the sector.

Trade Tensions and Government Shutdown Fears of additional tariffs on Chinese imports also hit New York-listed stocks. The ongoing U.S. government shutdown played a major role in capping market gains, adding uncertainty to the economic outlook.

Supportive Factors for Wall Street On the positive side, dovish signals from the Federal Reserve helped lift sentiment. The Fed’s tone suggested further interest rate cuts may be on the horizon. Quarterly earnings from key listed companies also supported the rally, with several outperforming market expectations.

Trump’s Tariff Shift Eases Trade Fears President Donald Trump initially floated the idea of a 100% tariff on Chinese imports. However, by week’s end, he called current tariffs “unsustainable” and confirmed plans to meet Chinese President Xi Jinping later this month—helping ease trade tensions.

Fed Officials Signal Easing Richmond Fed President Tom Barkin noted that U.S. productivity is improving, which could help offset inflation from trade tariffs. Boston Fed President Susan Collins added that “it would be wise for the Fed to continue cutting rates this year,” citing contained inflation risks and rising threats to the labor market.

Bank Earnings Reassure Investors Strong earnings from major banks helped stabilize the financial sector. JPMorgan Chase, Goldman Sachs, Wells Fargo, and Bank of America all posted results that exceeded market expectations, offering reassurance about the health of the banking industry.

Oil Posts slid after supply Fears reced

Oil prices recorded weekly losses, pressured by a combination of geopolitical developments and economic signals.

The decline was partly driven by reduced concerns over supply disruptions from the Middle East following a ceasefire agreement in Gaza. The deal between Hamas and Israel includes the exchange of hostages and detainees, as well as the repatriation of remains—marking the first phase of a broader peace initiative.

Global oil prices also came under pressure from a sharp increase in U.S. crude inventories last week, signalling weaker domestic demand.

Trade tensions between the United States and China intensified, adding further strain to oil markets. Meanwhile, the ongoing U.S. government shutdown has delayed key economic indicators, fueling uncertainty about the country’s economic outlook and contributing to the downward pressure on crude.

Recent data also pointed to slowing economic growth in China and the eurozone, raising concerns about future oil demand from two of the world’s largest energy consumers.

Bitcoin Faces Downward Correction

Cryptocurrency markets experienced notable volatility last week, with Bitcoin undergoing a fresh price correction while Russia recorded record-high trading volumes.

Bitcoin dropped more than 5.00% over the week, driven by profit-taking, reduced investor risk appetite, and movements in U.S. bond markets.

Russian trading platforms saw their highest activity since the start of the year, fueled by growing demand for cryptocurrencies as a hedge against domestic economic instability and international sanctions.

Ethereum also declined but held firm at key support levels. Altcoins showed mixed performance—Solana posted gains, while Dogecoin slipped.

Regulatory Oversight Intensifies

Regulators in both Russia and the United States continued to monitor the crypto market closely, with signs pointing to potential new restrictions, particularly around tax compliance and anti-money laundering measures.

Rising Institutional Interest

Despite the turbulence, several financial institutions expressed growing interest in digital assets, signalling a gradual shift toward viewing cryptocurrencies as long-term investment tools.

The week ahead

Markets are closely watching a potential summit between U.S. President Donald Trump and Chinese President Xi Jinping, following a week of heightened volatility across financial markets.

Investors are also focused on negotiations between Republicans and Democrats over a budget bill—either temporary or permanent—that could end the U.S. government shutdown, now entering its third week.

This week’s earnings reports feature major tech giants, known as the “Magnificent Seven,” with Tesla leading the lineup. Entertainment powerhouse Netflix is also set to release its financial results.

Among the most critical data points is the Consumer Price Index (CPI), which plays a key role in shaping the Federal Reserve’s interest rate decisions.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations