The Reserve Bank of Australia (RBA) is set to announce its interest rate decision on Tuesday, March 19th, 2024, at 2:30 PM Sydney time. This decision will be closely watched by businesses, borrowers, and investors for its impact on the Australian economy.

Market Expectation: Holding Scenario

Financial markets overwhelmingly anticipate the RBA to maintain the current cash rate of 4.35%. This comes despite recent inflation figures dipping below forecasts, suggesting the RBA’s previous rate hikes might be achieving their intended effect of curbing inflation. However, inflation still remains above the RBA’s target range of 2-3%.

Tax Cuts and Inflationary Tightrope

The upcoming stage-3 tax cuts, starting in July, are expected to boost household disposable income, potentially providing some relief from cost-of-living pressures. However, this added spending power could also reignite inflation if not carefully managed. The RBA will be monitoring this situation closely.

US Fed’s Influence: A Distant Echo

While the possibility of the US Federal Reserve reducing rates later in 2024 exists, the immediate impact on Australian monetary policy is seen as limited. The RBA sets interest rates based on domestic economic conditions and inflation targets.

Expert Opinions: A Cautious Outlook

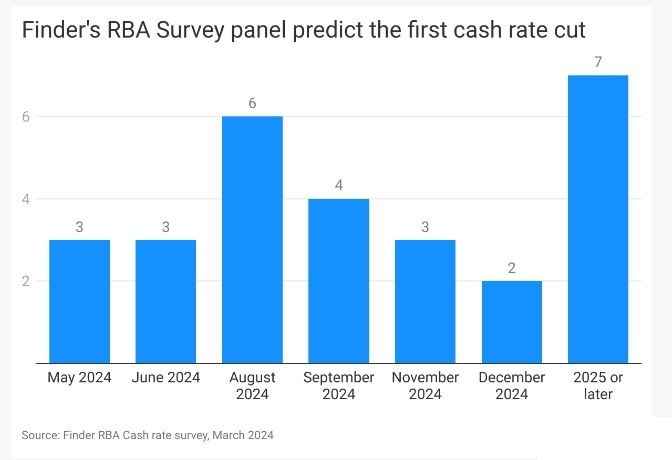

A recent Finder RBA Cash Rate Survey revealed that most economists don’t expect rate cuts until at least September. This cautious outlook reflects the RBA’s need to ensure inflation is under control before considering looser monetary policy.

The RBA itself has signaled a willingness to tolerate above-target inflation for a while compared to other central banks. This suggests a measured approach to future rate adjustments.

Divided Views on Tax Cut Impact

Economists are divided on the impact of the tax cuts. Some believe they will provide a modest economic stimulus without significantly pushing up inflation. Others warn that increased consumer spending fueled by tax cuts could lead to renewed inflationary pressures. The RBA will need to weigh these concerns when making future policy decisions.

Looking Ahead: A Balancing Action

The RBA’s decision on Tuesday will likely be to hold rates steady. However, the coming months will be crucial as the bank navigates the interplay between tax cuts, inflation, and potential adjustments by the US Federal Reserve. The RBA’s focus will remain on achieving its inflation target while supporting a healthy and stable Australian economy.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations