Gold prices have continued their upward trajectory, in full alignment with the bullish expectations outlined in our previous report. The metal successfully reached the projected target at $3,390, recording a session high at that level.

Technical Outlook:

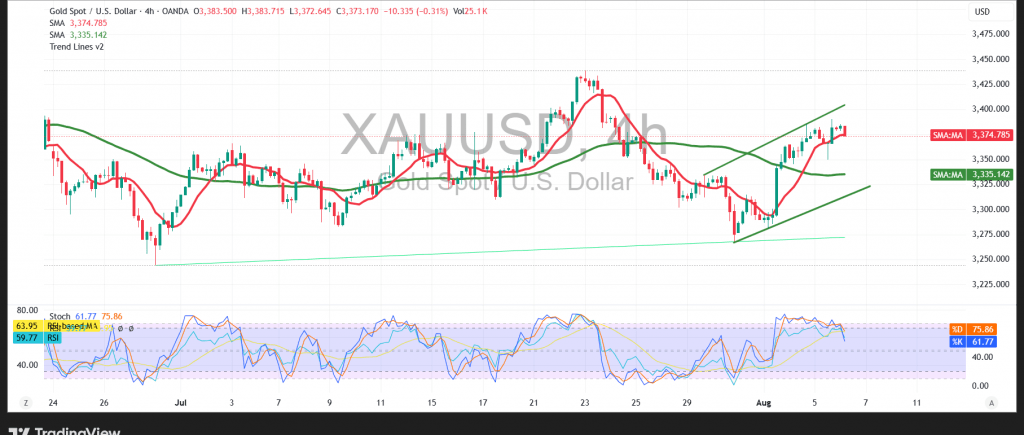

Following the test of the $3,390 resistance zone, prices experienced a mild intraday pullback, reflecting temporary selling pressure. However, the broader uptrend remains supported by the 50-period Simple Moving Average (SMA), which continues to serve as dynamic support. Additionally, the Relative Strength Index (RSI) has exited overbought territory, providing room for renewed bullish momentum.

Probable Scenario:

As long as gold holds above the $3,355 level—and more broadly, above $3,350—the bullish outlook remains valid. A confirmed breakout above the $3,390 resistance level would signal the continuation of the uptrend, with potential targets at $3,411, followed by $3,430.

Alternative Scenario:

A confirmed break below $3,350 and sustained hourly close beneath this level could trigger a short-term correction, exposing the price to a potential retest of the $3,329 support area.

Warning:

Market risks remain elevated amid ongoing geopolitical and macroeconomic tensions. Traders should anticipate sharp fluctuations in price, and all scenarios should be considered with appropriate risk management strategies.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations