The Consumer Price Index Report for July represented the awaited last obstacle to be overcome before the Federal Reserve cuts interest rates in September, just before their most recent meeting. Though even if the CPI figure is on the strong side, weaker-than-expected labour-market data since then indicates a drop is probably imminent.

What Decision Could Latest CPI Drive Fed to Make?

Following the meeting, Fed Chair Jerome Powell stated that rate cuts in September would not be determined by a “data-point dependent” approach, but rather by considering the “totality” of economic data. Two days later, the Labour Department announced that the unemployment rate increased to 4.3% and hiring had stalled in July.

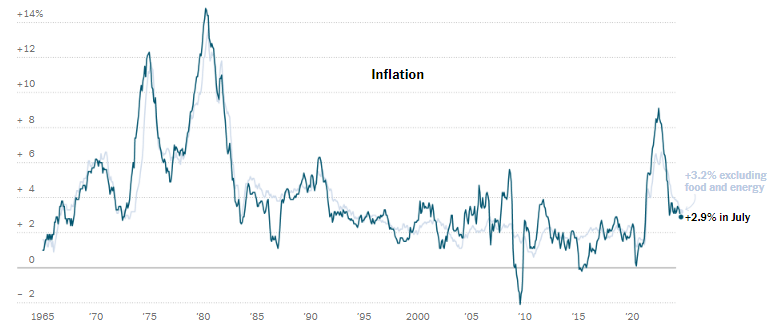

In the year ending in July, consumer prices increased by 2.9 percent, which was less than in the previous month. The Federal Reserve remains committed to lowering interest rates next month as a result of the report.

A further indication that inflation is slowing down and possibly keeping the Federal Reserve firmly on track to lower interest rates at its meeting next month is the Consumer Price Index’s July decline from a year earlier.

The Bureau of Labour Statistics announced that overall inflation in July was 2.9% annually, a modest decrease from 3% in June. The inflation rate was lower than predicted by economists and fell below 3 percent for the first time since 2021.

Following nearly two years of political backlash due to skyrocketing costs, the inflation report released on Wednesday gave many Democrats a sense of victory.

For the first time since 2021, consumer prices increased by 2.9 percent in the year ending in July. The Federal Reserve is expected to lower interest rates next month as a result of the report, which might improve economic optimism in the US before the November election.

On Thursday, Walmart will announce its quarterly financial results. It’s a useful indicator of how American consumers are doing, and this quarter’s data would include purchases for things like summer travel and early back-to-school purchases.

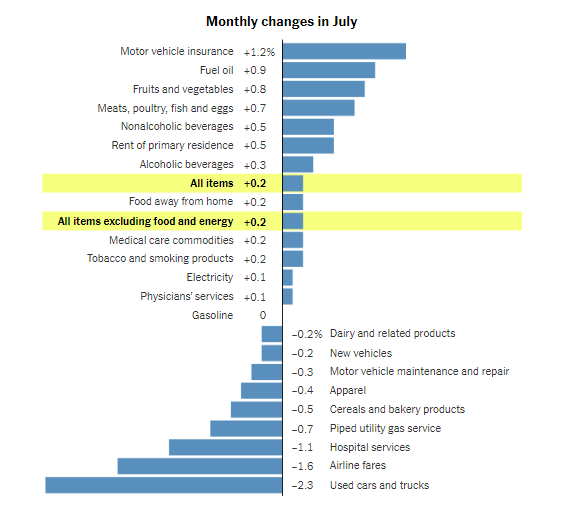

The firm, the biggest retailer in the US, has noticed that inflation has drawn more customers over the $100,000 mark, and analysts will be watching for indications that these customers have continued to visit the store even when inflation has decreased. In July, prices for a wide range of products, such as clothing, cars, and various groceries, were dropping. So did some of the service costs, such as airline tickets, which have been a major cause of the current inflation. However, some industries continue to be resistant, most notably auto and home insurance.

The inflation report has not caused the stock market to tremble. Once trade started this morning, it remained calm, indicating that the most recent inflation data was consistent with forecasts. Early morning trading saw very tiny climbs and declines in the S&P 500 and Nasdaq, but a 0.4 percent increase in the smaller-company Russell 2000 index.

Source: Bureau of Labor Statistics

The Russell index is a better indicator of the overall state of the economy than the S&P 500 or Nasdaq, which are dominated by large, international corporations, therefore its rise is significant. The CPI number was encouraging, but overall price increases are still causing problems for consumers. There is a growing body of evidence showing that consumers are having difficulty coping with the combined effects of high prices, rising interest rates, and a cooling labour market. In spite of the “as expected” statistics, prices increased last month overall.

Good News For Workers

For workers, lower inflation is good news. Over the past year, average hourly wages have increased by 0.7 percent, or 0.8 percent, for rank-and-file workers after accounting for inflation. In real terms, many workers are better off now than they were during the pandemic’s peak because nominal wages—which are not adjusted for inflation—are rising more slowly than they did during that period.

The shelter inflation in this case was a little firmer than anticipated, which was unexpected. Fed officials, on the other hand, have been patiently waiting for rent and an estimate of how much it would cost homes to relax their rent. That is not what they were looking for. Some economists speculated that this month’s results might be an anomaly.

For example, merely the rents in the West drove up the comparable measure significantly, which was linked to a boom in Los Angeles and Riverside. It appears to be noise as a result. Seeing a two handle on the annual CPI is fantastic. While this does not imply that policymakers have finished their work.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations