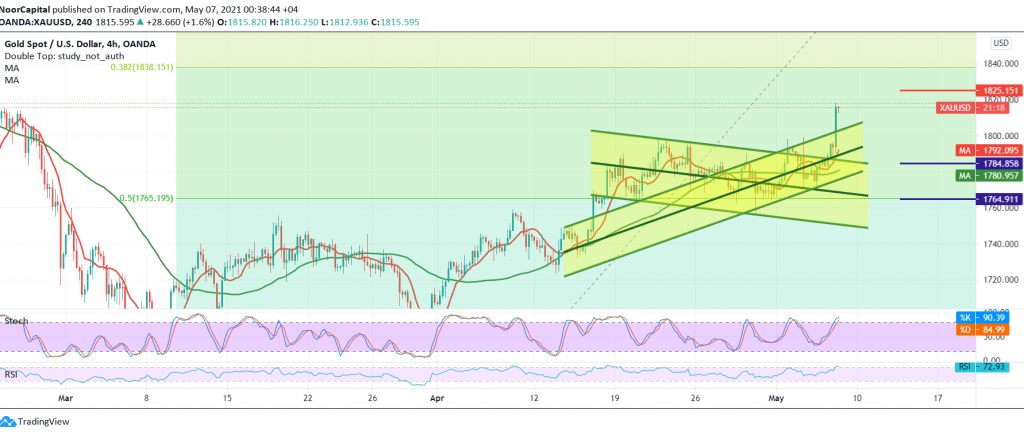

After several consecutive sessions of standing on neutrality, the price of the yellow metal witnessed noticeable rises, explained during the previous report that the activation of the buying centers requires a clear and strong penetration of the resistance level 1792/1795, which facilitates the task required to visit 1800 and 1810 respectively, initial stations to record gold at its highest level of 1817.

Technically, and with a closer look at the 240-minute chart, we find gold prices are stable above the simple moving averages, accompanied by the positive signs of the RSI.

From here, and with the breach of the resistance level 1795, which has now turned into a support level, and in general above 1785, the bullish tendency is likely today, targeting 1825 the first target, and then 1836 an official station awaited.

Only from below is the return of trading stability below 1784 capable of aborting the bullish trend, and we are witnessing negative trades with a target of 1775, and then 1765 initial targets: 50.0%.

Note: The US employment data are due today, and may witness heavy price fluctuations.

| S1: 1795.00 | R1: 1825.00 |

| S2: 1775.00 | R2: 1836.00 |

| S3: 1765.00 | R3: 1855.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations