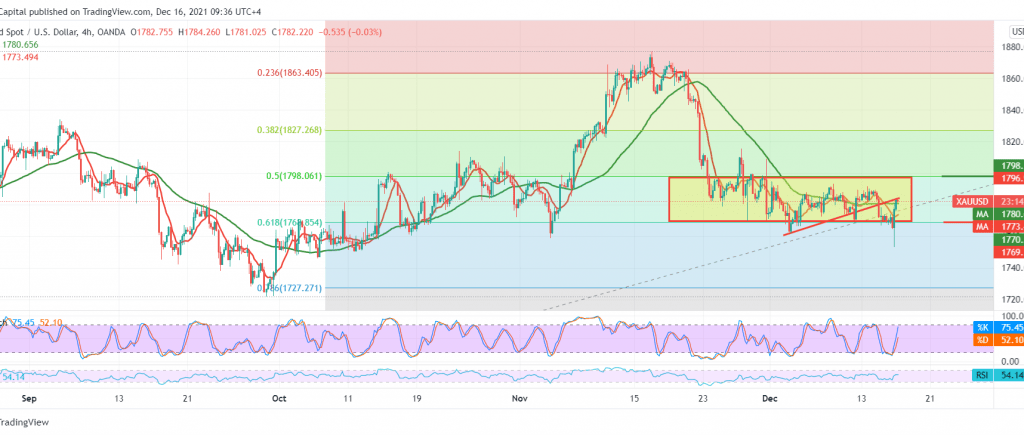

Mixed trading dominated the movements of the yellow metal after the Federal Reserve’s decision yesterday, recording its lowest level near the 1753 support, to return to the bullish rebound and is now hovering around 1783 areas.

On the technical side, the 14-day momentum indicator is stable above its mid-line, supporting the occurrence of a bullish bias during the coming hours, accompanied by the attempts of the 50-day moving average to hold the price from below.

Despite the technical factors that increase the possibility of the upside, we prefer staying on the fence as the price is in a range of 1768, Fibo 61.80%, and below 1799.00, 50.0%, and we wait for the activation of the following pending orders:

Activating long positions depends on confirming the breach of 1799.00 Fibonacci 50.0%. That catalyst contributes to consolidating gains to visit the top of 1817 and then 1827 retracement of 38.20%.

Activating short positions requires that we witness a clear and robust break of the pivotal demand point 1768.00, retracement of 61.80%, to target the long position 1734.

| S1: 1761.00 | R1: 1792.00 |

| S2: 1741.00 | R2: 1803.00 |

| S3: 1730.00 | R3: 1823.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations