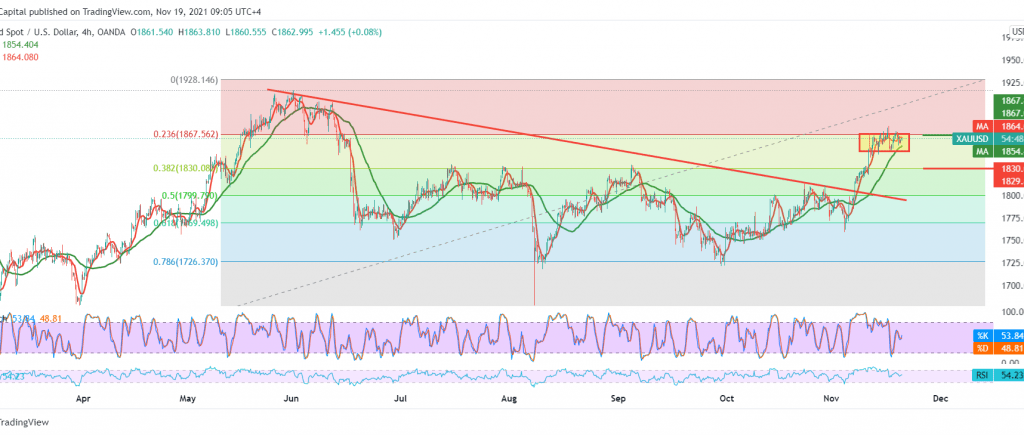

The yellow metal is witnessing sideways narrow range movements, limited between support of 1855 and resistance of 1867.

Technically, we find that gold prices are still stable below the main supply areas at 1868, 23.60% Fibonacci correction. However, we see the price trying to stabilize above the 50-day moving average with careful consideration, which technically contradicts the clear negativity on the stochastic indicator.

Therefore, with the price receding within the sidetrack mentioned above, in addition to conflicting technical signals, we will stand aside to obtain a high-quality deal and maintain the recently achieved profitability.

The buying positions require to witness the stability of the price according to the clear demand areas around 1854. We also need to witness the breach of 1867 that can reinforce the gains in gold so that we are waiting to touch the previous peak 1877 and then 1884.

Activating short positions depends on confirming the break of 1854, and from here, we are witnessing a trading session in the red areas, with its initial targets located around the 1835 level.

| S1: 1854.00 | R1: 1868.00 |

| S2: 1847.00 | R2: 1877.00 |

| S3: 1835.00 | R3: 1884.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations