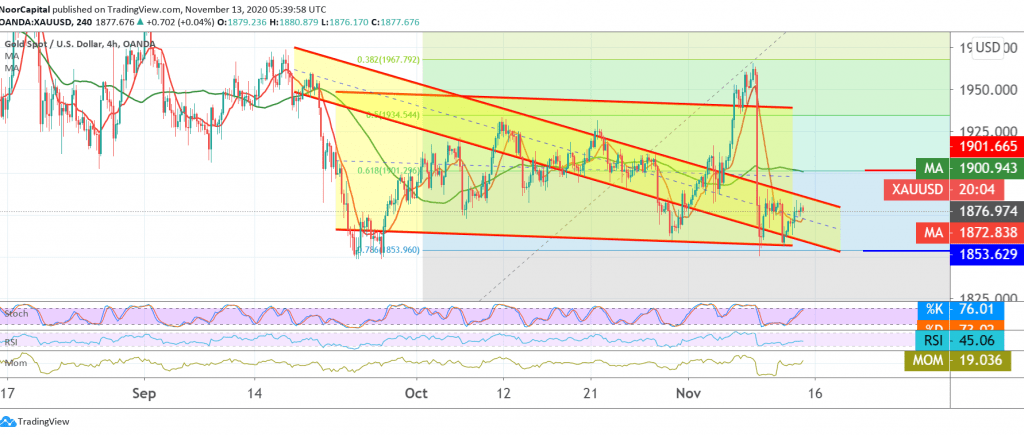

The movements of the yellow metal witnessed positive attempts during the previous trading session and are still limited, targeting a re-test of the 1882 resistance level.

Technically, we notice a contradiction between the technical signals, and by looking at the short time intervals, we find that the RSI indicator is providing positive signals, on the other hand, we find the stochastic indicator and the moving average 50 providing negative signals on the 4-hour interval.

Although we tend to be negative, we will be on the fence momentarily, waiting for one of the following scenarios: To resume the bearish path, we need to witness price stability below 1886, and it is important to confirm a break of 1862 in order to facilitate the required mission towards the awaited target of 1853 then 1845.

Activating short positions temporarily depends on breaking 1886, and from here we may witness a re-test of the previously broken support that turned into resistance 1901, Fib 61.80%, which represents the key to protecting the downside.

| S1: 1865.00 | R1: 1886.00 |

| S2: 1853.00 | R2: 1895.00 |

| S3: 1844.00 | R3: 1907.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations