Gold prices surged significantly, propelled by intensifying geopolitical tensions, surpassing the official target of $3,416 mentioned in the previous technical report and reaching a new all-time high of $3,451 per ounce.

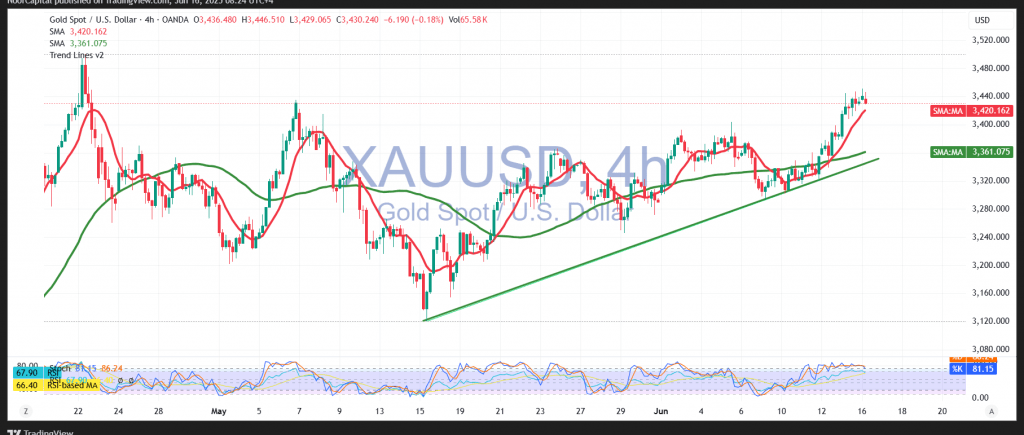

Technically, while the Relative Strength Index (RSI) indicates overbought conditions, which could suggest a temporary slowdown, the broader trend remains bullish. This is confirmed by the continued support from the simple moving averages, which are aligned with the upward price curve and reinforce the dominant bullish structure.

Although a short-term pullback cannot be ruled out, the potential for a renewed upward move remains valid. If gold successfully breaches the $3,461 resistance level, it could serve as a fresh catalyst for accelerating the bullish momentum, with the next target set around $3,492.

Reminder: Sustaining daily trading above the critical demand zone of $3,390 is essential to maintain the bullish outlook. A drop below this level may signal a loss of momentum and increase the risk of corrective moves.

Warning: Risk remains elevated due to ongoing trade and geopolitical uncertainties. Traders should be prepared for high volatility and potential sudden market shifts.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations