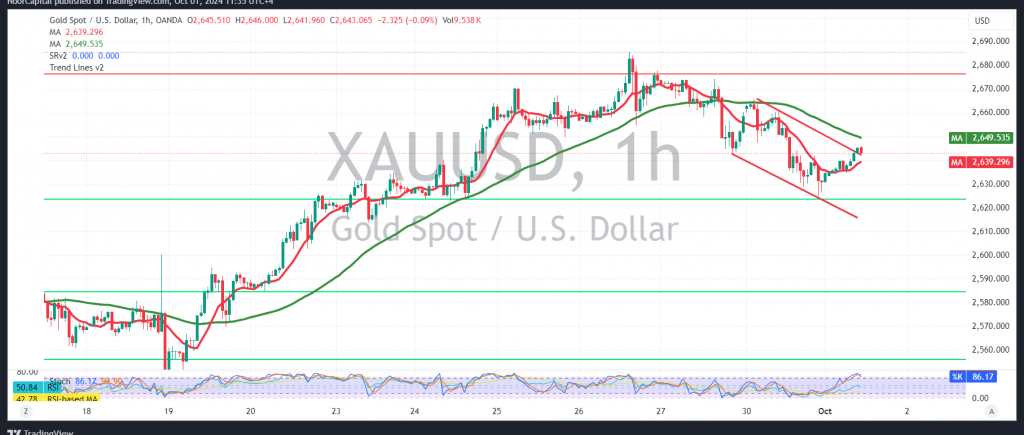

Gold prices have been trading in a narrow sideways range, with support holding above the 2645 DGM level and resistance below 2665.

The technical outlook for today suggests the possibility of continuing the corrective decline, especially after gold failed to break through the 2665 resistance. A closer look at the 240-minute chart reveals ongoing negative signals from the 14-day momentum indicator, coupled with downward pressure from the 50-day simple moving average.

As long as intraday trading remains below the 2665 resistance level, the downward correction remains valid. A break below 2644 would likely accelerate the decline, with 2631 as the initial target. Further downward pressure could push prices towards 2620 and 2605.

However, if gold manages to breach the 2665 level and consolidate above it, this would signal a return to the bullish path, with potential gains targeting 2685 and 2700.

Warning: The overall long-term trend is still upward, but risks remain elevated.

Caution: Today we expect high-impact economic data from the US, including “Unemployment Benefits” and “ISM Services PMI,” which could result in significant price volatility.

Risk Warning: The risk level remains high due to ongoing geopolitical tensions, and all scenarios remain on the table.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations