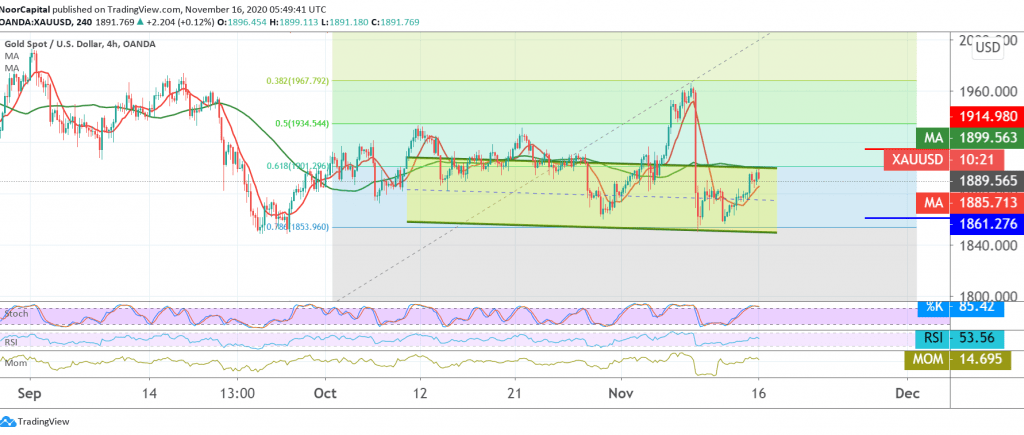

We remained neutral in the previous analysis due to the conflicting technical signals, with activation of long positions depends on confirming the breach of 1886, and from here we may witness a re-test of the previously broken support-into-resistance 1901, posting a high at 1899.

Technically, looking at the 240-minutes chart, we find the 50-day moving average trying to press the price from the top and the pair stable below pivotal resistance 1901, Fib 61.80%, which represents a key to protecting the downside, this contradicts the positive signals coming from the RSI and with the formation of a bullish technical pattern.

Therefore, we will stand on the fence for the second session in a row in order to get a good deal, and we will be waiting for one of the following scenarios: The price breaches the 1901 level, fib 61.80% is a catalyst that enhances the chances of a rally towards 1913 as a first target, followed by 1927.

Activation of short positions depends on witnessing a clear break of the support level of 1890 and puts the price under strong negative pressure to resume the bearish path with initial targets at 1860.

| S1: 1877.00 | R1: 1901.00 |

| S2: 1863.00 | R2: 1913.00 |

| S3: 1852.00 | R3: 1927.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations