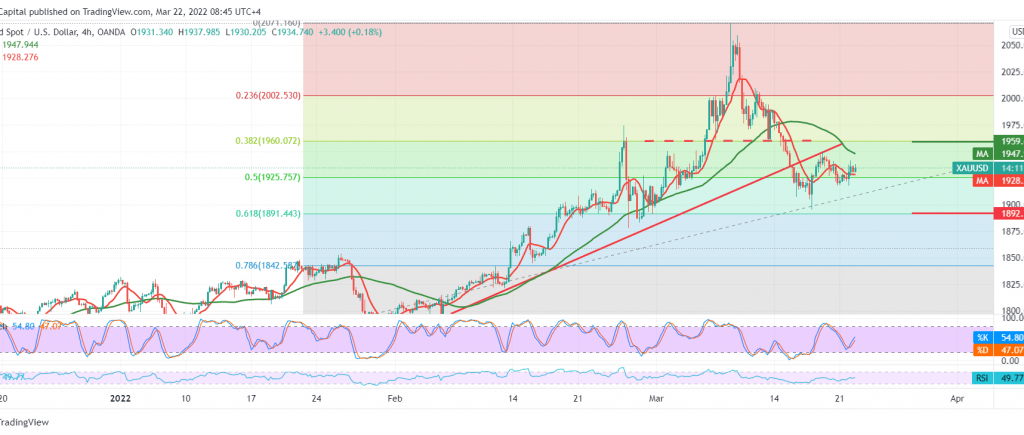

Gold failed to confirm breaking the pivotal support level published during the previous report at 1925, explaining that the mentioned support level represents the key to protecting the bullish trend on the intraday term to conclude the previous session’s trading above 1925 and is now hovering around its highest level during the early trading session of today’s session 1936.

Technically, consolidation above 1925 represented by the 50.0% Fibonacci correction supports the possibility of a rise, in addition to the stability of the RSI above the mid-line 50, on the other side, we find the 50-day moving average that constitutes an obstacle to the price and meets around the 1946 resistance and adds more strength to it.

Therefore, we prefer to wait until the price is moving from below 1925, and this puts the price of gold under negative pressure to visit 1908 and 1891, 61.80% correction, an official station while rising above 1944 and most importantly 1946 leads gold to recover with the goal of 1954, and it may extend later towards 1960, 38.20% correction.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations