The intraday movements of gold prices witnessed a bearish tendency during the previous trading session, within the expected bearish path, in which we relied on confirming the breach of the 1925 support level to visit 1908, recording the lowest level at 1910.

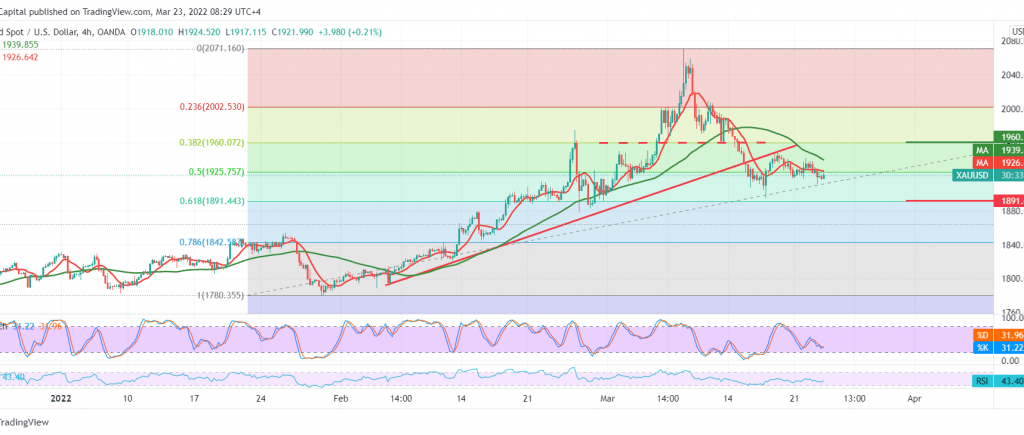

On the technical side, gold prices are witnessing stability again above the 1925 strong support level represented by the 50.0% Fibonacci correction, as shown on the 4-hour chart, and this may add movements towards the positive areas, and on the other hand, we find the 50-day moving average that is still a hindrance The price prevents further advances and converges around 1940/1942 and adds more strength.

With conflicting technical signals and limited trading from below above 1925 and from above below 1942, this makes us wait until the mentioned price range is released.

Confirmation of breaking 1925, 50.0% correction, extends gold’s losses, and the awaited official station 1891, 61.80% correction, while attempts to consolidate above 1942 may restore gold prices to recover again, to be waiting for 1951 and 1960, respectively.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations