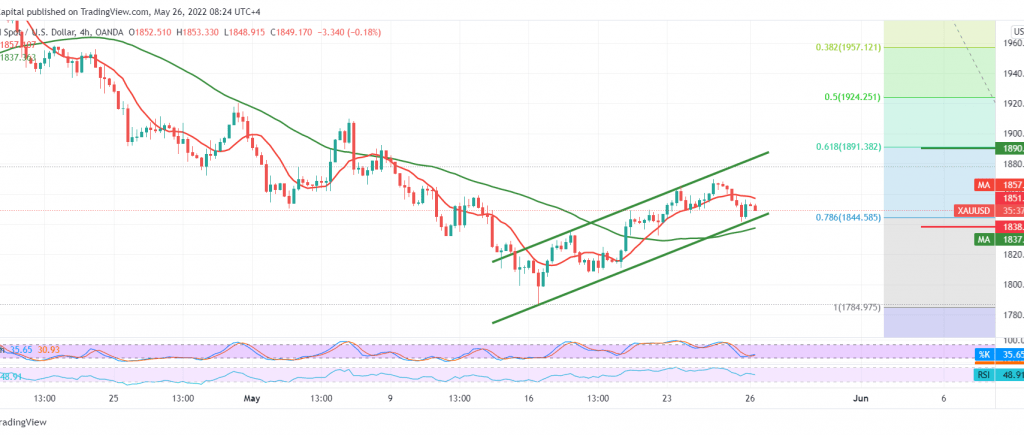

Negative movements dominated gold prices during the previous trading session within a limited bearish tendency after failing to maintain trading above 1850 to retest 1840 successfully.

On the technical side today, we find the 50-day moving average that continues to support the bullish price curve and the stability of daily trading above 1840 and, most importantly, 1838.

The possibility of rising is valid, but We need to witness consolidation ion above 1857, and this is a catalyst that enhances the chances of the rise to visit 1865 next station. A break there may extend gold’s gains to visit 1871 and 1877. The official target is located around 1891 Fibonacci correction 61.80 % as long as the price is stable today above 1838.

We remind you that the decline below 1838 and the price stability below it leads the price to retreat, so we are waiting for 1825 and 1810, respectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations