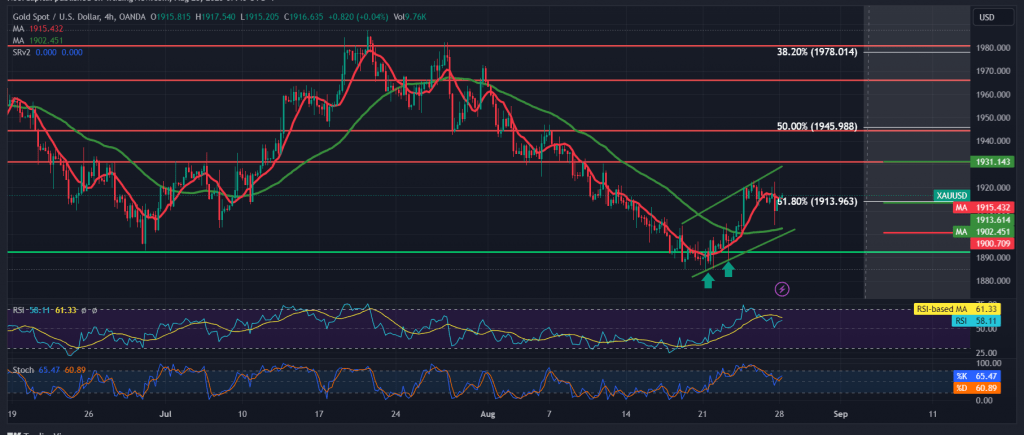

Gold prices achieved an intraday break of the strong support floor published during the previous technical report at the price of 1913, explaining that the decline below the mentioned support level puts the price under negative pressure again, so we are awaiting the return of the official bearish trend, with targets starting at 1908 and 1903.00, recording its lowest level at $1903 an ounce.

Technically, by looking at the 4-hour chart, we find that gold prices are trying to stabilize above 1913, Fibonacci correction 61.80%, accompanied by obtaining a positive motive from the simple moving averages that returned to hold the price from below, in addition to attempts by the RSI to gain more momentum Bullish on short time frames.

There may be an upward bias during the coming hours, targeting 1924 and 1929 respectively, considering that price consolidation above 1929 may initially enhance the intraday gains for visiting 1932.

Only from below, a decline below 1913, with a 4-hour candle closing below it, puts the price under negative pressure again, to be waiting for the return of the official bearish trend, with targets starting at 1908 and 1903.00, and the losses extend towards 1885.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations