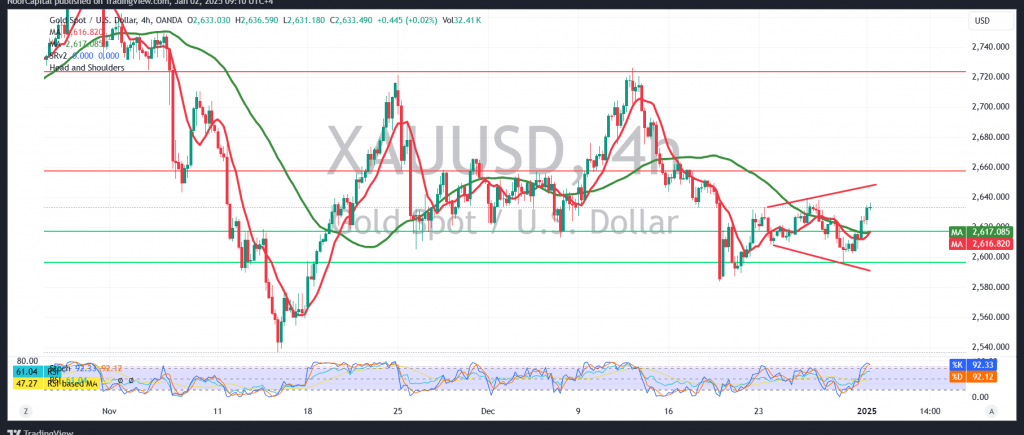

Gold prices are attempting a modest upward correction during the early trading sessions of this week, reaching a high of $2636 per ounce in today’s initial trades.

Technical Analysis:

A closer examination of the 4-hour chart reveals that the Stochastic indicator has entered overbought territory, coinciding with the price’s continued movement below the key resistance level at $2640.

As long as intraday trading remains below $2640, the bearish scenario remains favored. The initial downside target is $2610, with a break below this level likely to exert additional selling pressure, pushing prices toward $2600.

Conversely, a sustained breakout above $2640 would invalidate the bearish outlook, potentially setting the stage for a recovery. In such a scenario, gold prices may aim for $2645 and $2657 as immediate upside targets, with further gains potentially extending to $2680.

Risk Considerations:

Given the heightened geopolitical uncertainties, volatility remains a significant factor. Traders are advised to exercise caution, as market movements may deviate from technical expectations.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations