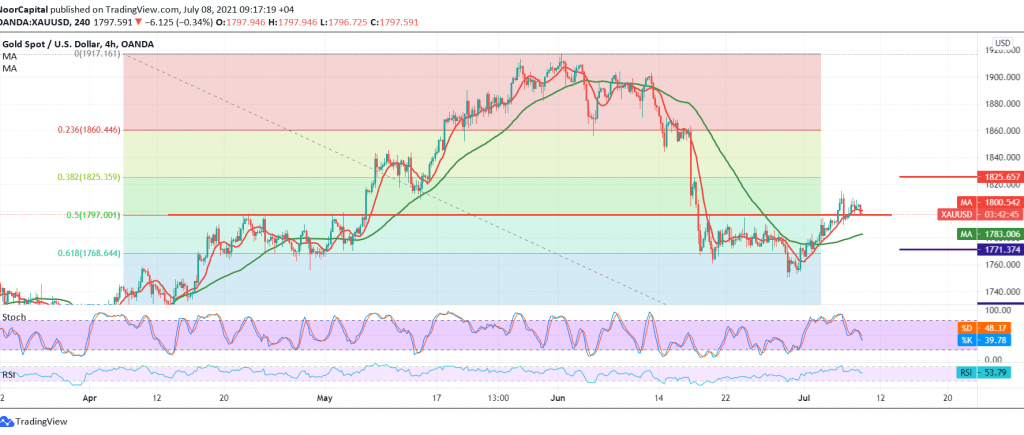

The prices of the yellow metal declined noticeably at the beginning of this week after it failed to breach the resistance level of 1815, which is our target to be achieved during the previous report.

On the technical side today, and looking at the 4-hour chart, we tend to trade negatively, but with caution, relying on the clear negative signs on Stochastic that coincide with the negativity of the RSI.

From here and steadily trading intraday below 1805 and in general below 1815, the bearish scenario remains valid and effective, targeting 1790/1789, knowing that breaking the mentioned level will extend gold losses, paving the way to 1773/1770.

To remind you that stability above 1815 will immediately stop any attempts to fall, gold recovers with an initial target of 1825. Alert: The level of risks may be high.

| S1: 1789.00 | R1: 1805.00 |

| S2: 1783.00 | R2: 1815.00 |

| S3: 1773.00 | R3: 1821.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations