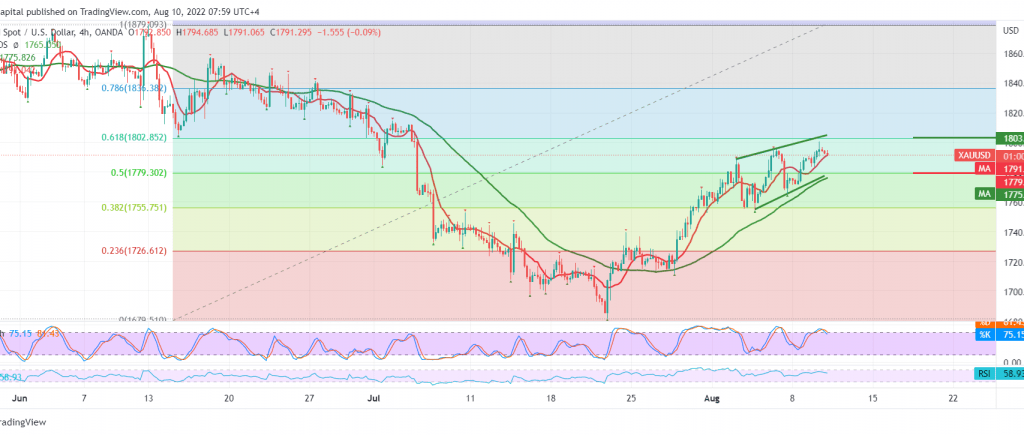

Gold prices achieved the positive outlook as we expected, reaching the first target mentioned in the previous report, at 1797, attacking the psychological resistance level of $1800 per ounce.

Today’s technical view indicates the possibility of an upside potential based on the price’s success in surpassing the upside and consolidating above 1779 resistance 50.0% Fibonacci correction, as shown on the chart, in addition to the bullish momentum signs on the 14-day momentum indicator.

Despite the technical factors that support the possibility of a rise, the confirmation of the breach of 1802 retracement of 61.80% is a basic condition and a catalyst that enhances the chances of touching 1808 and 1816 respectively as long as the price is stable above 1779.

The decline below 1779 might put the price under temporary negative pressure that targets a retest of 1774 and then a retest of the support line 1765.

Note: Stochastic tends to intraday negativity.

Note: CPI figures are due during the US session, which has a high impact; and may lead to high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations