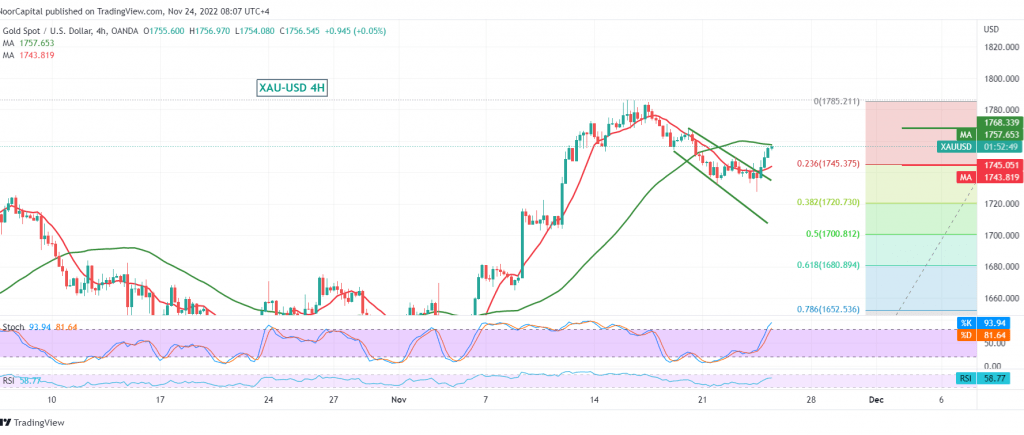

Gold prices succeeded in touching the official target of the corrective bearish wave mentioned in the technical reports for the current week, as we expected to touch the target at 1720, recording its lowest level at 1720, to return within an upward rebound, and it is now trading around $1756 per ounce.

Today’s technical vision indicates the possibility of resuming the bullish tendency that started due to touching the pivotal demand area 1720. In addition, we notice gold’s attempts to stabilize above the 50-day simple moving average, which meets around 1756.

The expected trend tends to the upside, and targets start at 1768, an initial station, taking into consideration that consolidation above the aforementioned level is capable of consolidating gains towards 1777, which represents a pivotal resistance level around which price behavior must be monitored because its breach opens the door to be waiting for an ounce of gold around 1787.

Stability in intraday trading below 1745 may force gold to retest 1732 before attempting to rise again.

Note: US markets are on holiday due to Thanksgiving, and volumes are light

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations