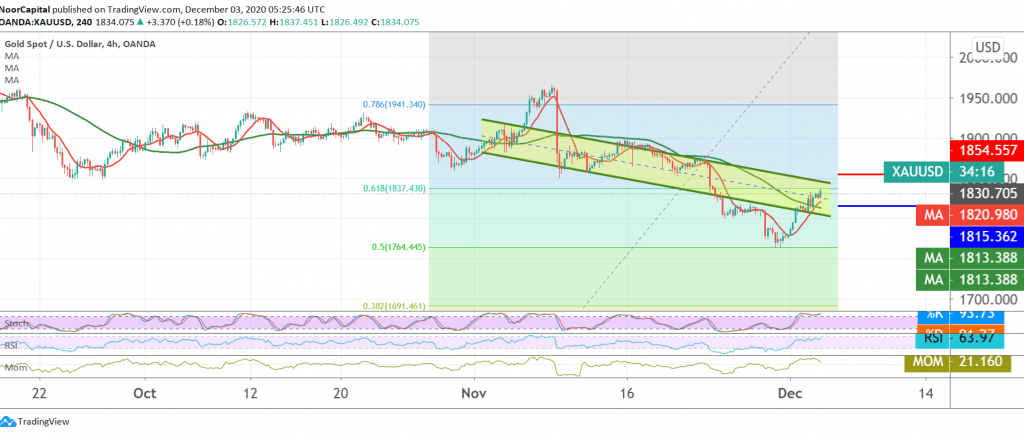

We committed to the intraday neutrality during the previous analysis, although we tend to the positivity, indicating that we are waiting to confirm the breach of the resistance level of 1817, which is a catalyst factor that enhances the chances of the rise to be the next leg of 1837, Gold peaked at 1837 during the early trading of the current session.

Technically, by looking at the 4-hour chart, we find the simple moving averages returned to hold the price from the bottom, and the 50-day average meets around 1815/1813 and adds more strength to it, and we find the RSI continues to provide positive signals.

From here, with intraday trading above 1815, we believe that the possibility of continuing the slight bullish correction within the bearish trend is still an important condition, and it is necessary to breach 1837, correcting 61.80%, a catalyst that increases the chances of the upside towards 1845, and the gains may extend to re-test 1855.

A reminder that the return of trading stability and price stability again below 1815/1813 will negate the bullish scenario, and we will witness a bearish slope initially targeting 1796.

| S1: 1815.00 | R1: 1845.00 |

| S2: 1796.00 | R2: 1855.00 |

| S3: 1785.00 | R3: 1875.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations