Prices of the yellow metal declined significantly during the previous trading session, touching the second official target required to be achieved in the last technical report, at 1761, recording its lowest level at 1761.00.

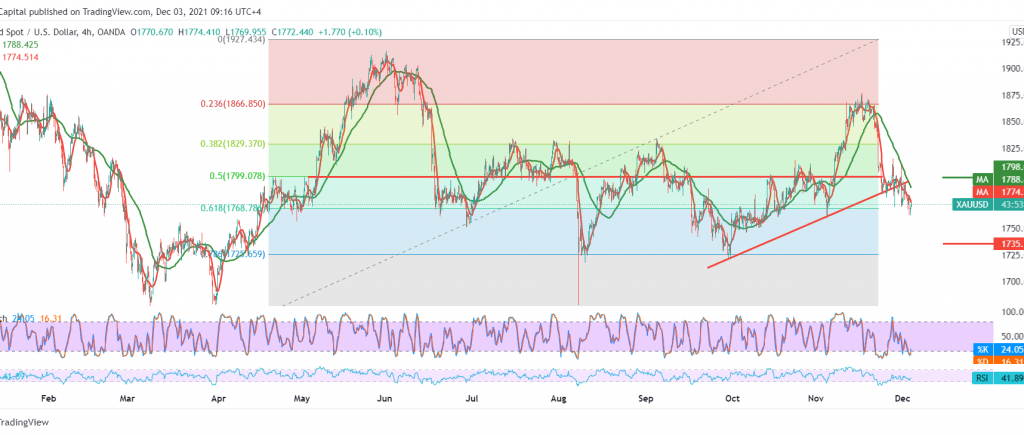

On the technical side today, and by looking at the 4-hour chart, we notice that gold obtained a negative closing below the 1768 level, the 61.80% Fibonacci correction, with the continuation of the negative pressure coming from the simple moving averages.

Therefore, the anticipatory path of the gold trend during the day is bearish, targeting 1761, and breaking it increases the acceleration of the decline, to be waiting for the next price target 1750 and 1739, respectively.

Activating the suggested bearish scenario requires daily trading to remain below 1780, and breaching it increases the possibility of a slight bullish bias that targets retesting 1799, 50.0% correction, before retracing.

Warning: Today, we are waiting for US jobs data, average wages, and US unemployment rates, and we may witness high fluctuations in prices.

| S1: 1761.00 | R1: 1783.00 |

| S2: 1750.00 | R2: 1794.00 |

| S3: 1739.00 | R3: 1805.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations