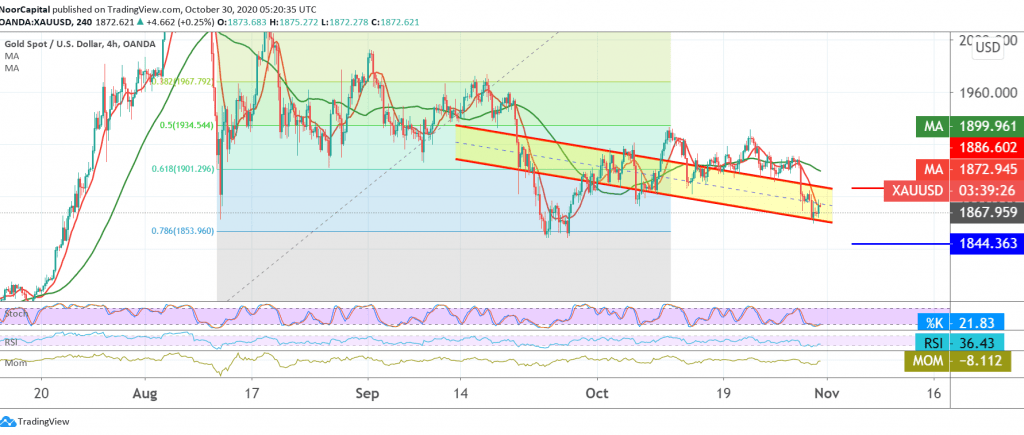

Gold prices witnessed a noticeable decline during the previous session’s trading towards the first official target for the downside wave, as we expected at 1860.

Technically, the daily trend is still bearish, given the consolidation of intraday trading below the previous broken support 1882, with the continued negative pressure of the simple moving averages, in conjunction with the clear negativity on the stochastic indicator.

This encourages us to maintain negative while observing the price behavior around 1860, because breaking it accelerates and confirms the strength of the daily bearish trend towards 1845/1848 and may extend later towards 1836.

The stability of trading and the rise above 1882 and the most important of 1886 delays the chances of a reversal, and we witness a re-test of 1901, FIB 61.80%, before attempts to retreat again. Warning: the RSI indicator is providing clear positive signals on short time frames.

| S1: 1861.00 | R1: 1886.00 |

| S2: 1845.00 | R2: 1898.00 |

| S3: 1836.00 | R3: 1911.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations