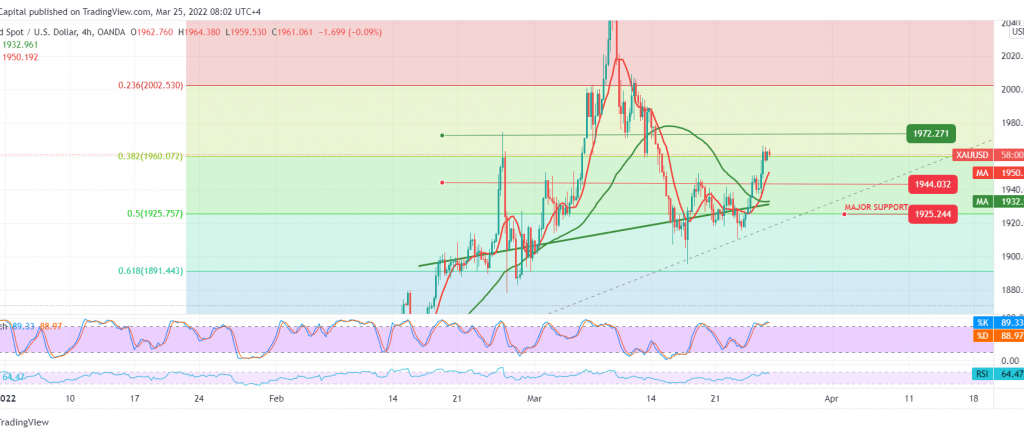

Gold prices maintained their gains as we expected to reach the official target at 1960, recording its highest level of 1966.00.

Today’s technical vision indicates the possibility of resuming the rise, with the price confirming the breach of the 1943 resistance-into-support level and the positive signals coming from the 14-day momentum indicator on the short time frames.

Therefore, the upward path may be the most likely, knowing that consolidation above 1966 can push gains for the visit of 1972, the first target, and the gains may extend later towards 1983, the next station.

The return of trading stability below 1943 leads gold prices to retest the pivotal support level 1925 represented by the 50.0% Fibonacci correction.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations