Gold resumed its bullish momentum during the previous session, surpassing the official target of $2700 per ounce and recording its highest level at $2720.

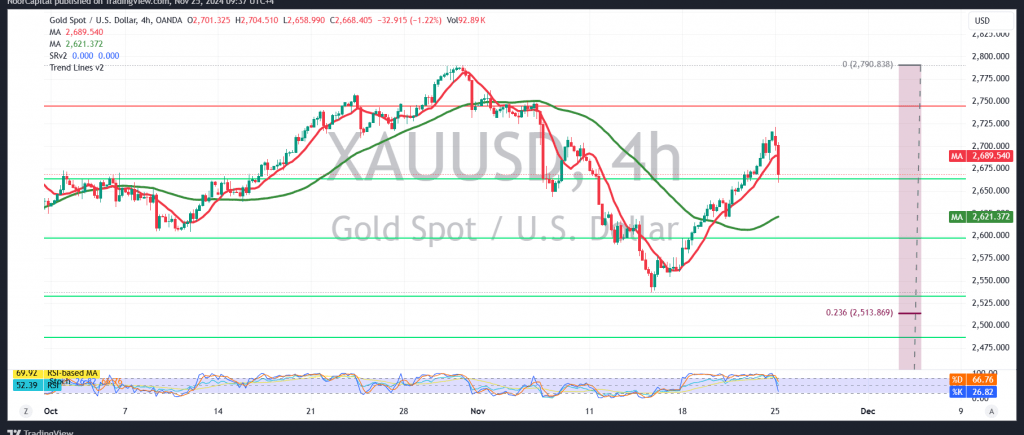

From a technical perspective, the current movement shows a slight bearish tendency due to encountering the pivotal resistance at $2720. However, a closer look at the 4-hour chart indicates that the simple moving averages continue to support the chances of further upside, while the Stochastic indicator is attempting to generate additional positive momentum that could push prices higher once again.

Trading stability above $2710 facilitates the path towards $2746 as an initial target, with the potential for gains to extend to $2770. A breach of this level could accelerate the bullish trend, paving the way for $2790 as the next official station.

It is important to note that a return to trading stability below $2645 could invalidate the bullish scenario and push gold back into a downward corrective path, opening the way towards $2620 and possibly extending to $2582.

Warning: The risks remain high amid ongoing geopolitical tensions, and all scenarios remain on the table.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations