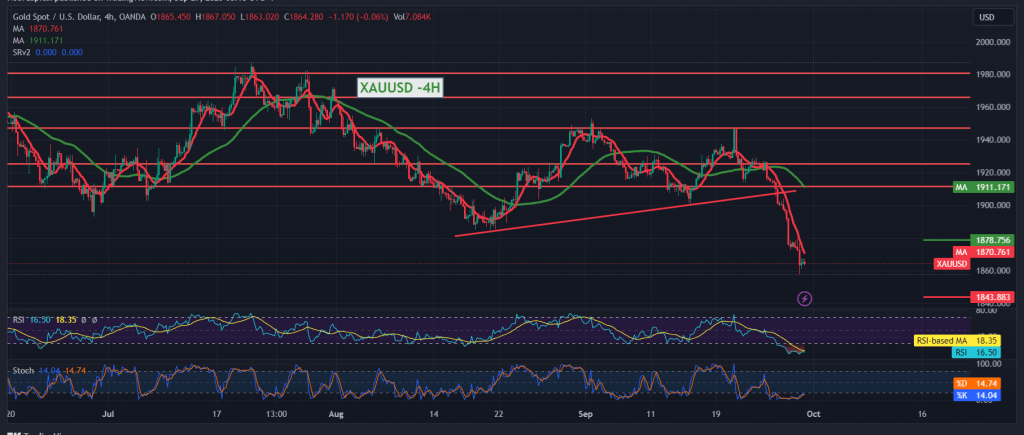

Gold prices incurred significant losses during the previous trading session as part of the downward directional movement, as we expected, touching all the required targets at 1864, approaching the third target by a few points at 1853, only to record its lowest price of $1857 per ounce.

Technically, gold prices are trying to achieve some upward rebound. However, the rebound is still weak and limited, and prices remain stable below the resistance of 1875 and in general below 1878, in addition to the continued stability of prices below the simple moving averages that continue to exert negative pressure on the price from above.

Therefore, the bearish scenario remains the most preferable during today’s trading, taking into account that sneaking below 1853 facilitates the task required to complete the bearish wave, as we are waiting for 1844, the first target, and then 1831, the next station, whose negative targets may later extend towards 1815.

The price’s consolidation above 1878 with the closing of at least an hour candle will lead the price quickly and directly to retest 1888 and 1897, respectively, before the new price range is determined.

Note: Today we are awaiting high-impact economic data issued by the American economy, the Core Personal Consumption Expenditure Index, and we may witness high fluctuation in prices at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations