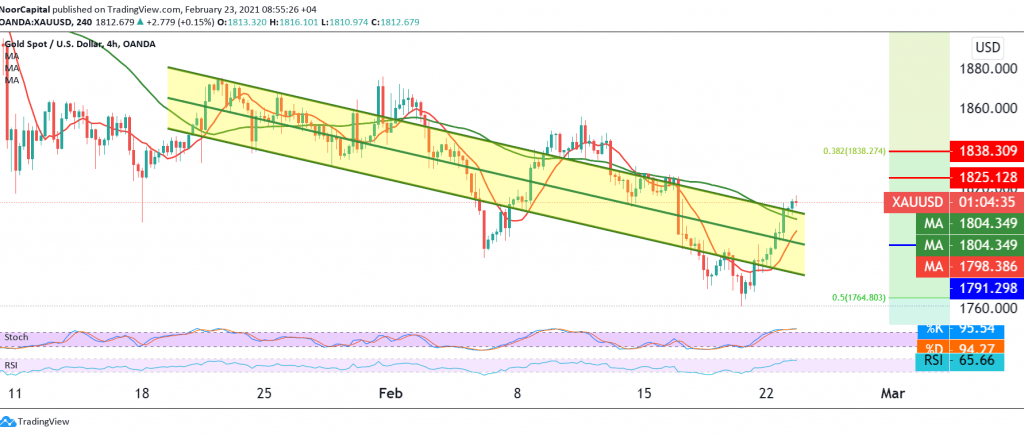

The yellow metal prices witnessed a bullish wave with the opening of the first trading sessions of this week, to witness the intraday movements stabilizing above the psychological line of 1800 resistance.

On the technical side, stability trading above 1800 supports the rise, and with a closer look at the chart, we find the 50-day moving average to hold the price from below, and we find the RSI indicator providing positive signals, and on the other hand, the stochastic indicator is trading around clearly overbought areas.

We tend to the negativity, but we need to stand on the fence for a moment until the signal becomes clearer in a more accurate way, to be in front of one of the following scenarios:

To get a bullish trend, we need to witness the breach of 1816 to target 1825, and the gains may extend later towards 1838, a correction of 38.20%. Reactivating the short positions requires breaking 1790, and therefore we are witnessing a bearish tendency, the initial target of which is 1780, and then 1770 next stations.

| S1: 1790.00 | R1: 1825.00 |

| S2: 1768.00 | R2: 1838.00 |

| S3: 1755.00 | R3: 1860.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations