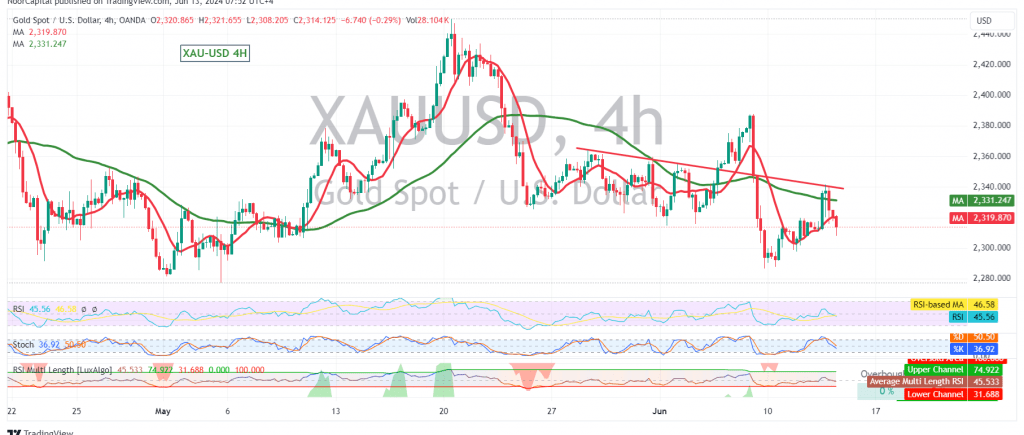

Gold prices experienced mixed trading in the previous session, influenced by the Federal Reserve’s interest rate decision. On the 4-hour chart, the key resistance level of 2340, as previously highlighted, successfully capped the upward movement. Gold’s inability to breach this level, combined with the persistent negative pressure from simple moving averages and the Stochastic oscillator, suggests a potential continuation of the corrective decline.

Outlook and Trading Strategy

We maintain our view that a further corrective decline is likely, with an initial target of 2300. A decisive break below this level would accelerate the downward momentum, paving the way for potential losses towards 2272.

However, it’s important to emphasize that the continuation of this scenario depends on the price remaining below the critical 2340 resistance level. Any successful attempts to breach this level could trigger a temporary recovery towards 2360 and even 2367.

Important Note

Today’s release of high-impact U.S. economic data, including annual producer prices and basic monthly/annual producer prices excluding energy and food, could lead to significant price volatility. Traders are advised to exercise caution and closely monitor market reactions to these data releases.

Key Levels:

- Resistance: 2340

- Support: 2300

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations