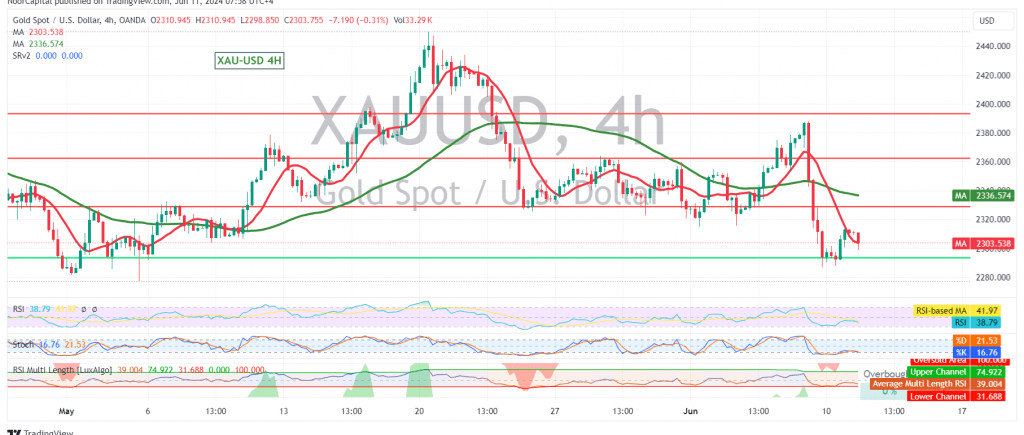

Gold’s price movement remains aligned with our previous technical assessment, continuing its downward corrective path, reaching a low of $2287.00 per ounce.

On the 4-hour chart, we observe a clear break below the previously breached support level of 2318.00. This, coupled with negative pressure from the simple moving averages and a bearish technical formation, strengthens our conviction that the corrective decline is likely to continue.

Our primary downside target is 2272.00. A break below this level would accelerate the downward momentum, potentially leading to further losses towards 2263.00 and even 2220.00.

It’s important to note that the continuation of this scenario hinges on the price remaining below the key resistance level of 2340.00. Any attempts to breach this level could trigger a temporary recovery towards 2360.00.

Key Points:

- Gold remains in a corrective downtrend.

- The 2272.00 level is a critical support to watch.

- Traders should consider short positions with caution, setting appropriate stop-loss orders.

- Given the ongoing geopolitical tensions, high price volatility is expected, increasing the level of risk.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations