The yellow metal prices achieved good gains at the end of last week’s trading for the third consecutive session, after it succeeded in building on the support floor of 1755, recording its highest level of 1767, taking advantage of the weakness of the US currency.

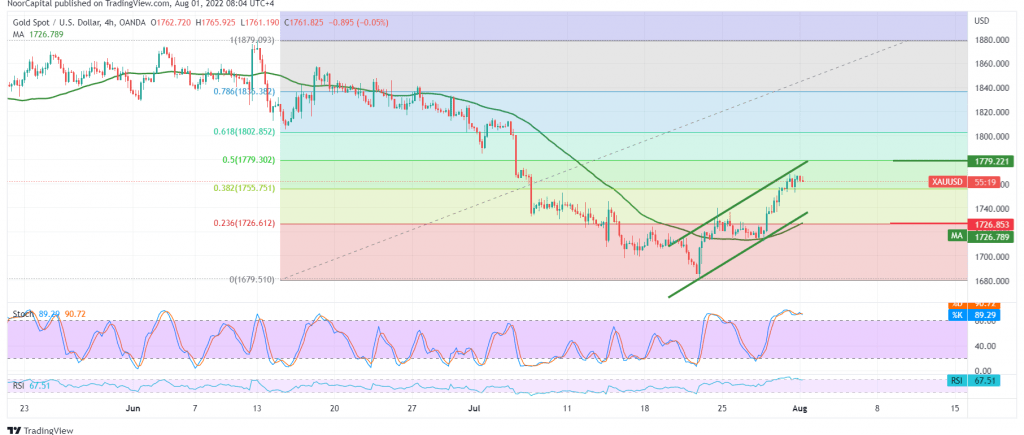

Technically, by looking at the 4-hour chart, we notice the regularity of movement within the bullish price channel, so the price tries to hold above 1755.

However, with careful consideration, the price is now hovering around a pivotal resistance level around 1770, accompanied by the positive motive of the simple moving averages that support the possibility of an upward during today’s session comes in conjunction with the 14-day momentum indicator getting more positive signs.

We tend to be positive, but on the condition that we witness a clear and strong breach of the 1770 resistance level, and that is a catalyst to enhance the chances of rising towards 1780/1770, taking into consideration that the recent breach opens the door towards 1800, 50.0% Fibonacci correction.

Activating the suggested scenario requires stability above 1755, most notably 1750, and breaking the latter leads the price to the downside path, with an initial target of 1730.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations