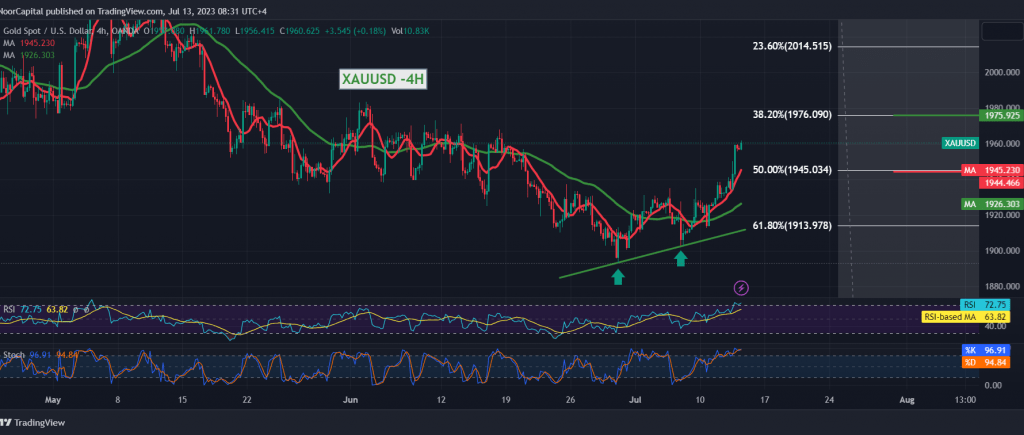

Gold prices recorded significant gains, taking advantage of the weakness of the US dollar, explaining that we are monitoring the price behavior until the breach of the main resistance level of 1945 is confirmed, explaining that this enhances the chances of touching 1961, so that gold prices succeed in recording their highest level at $1961 per ounce.

Today’s technical vision indicates the possibility of continuing the rise, depending on the positive impulse from the simple moving averages that support the daily bullish price curve and the bullish technical formation shown on the 4-hour chart.

From here, with trading above the previously breached resistance, which is currently transformed into a support level, at the price of 1945 Fibonacci correction 50.0%, the bullish direction is the most preferred, targeting 1970 and 1976 as initial targets that may extend later towards $2000 per ounce as an initial main station.

To remind you that closing at least an hourly candle below 1945 nullifies the activation of the suggested scenario, and the offending trend returns to control gold’s movements. We axqre witnessing a re-test of 1913 correction of 61.80%.

Note: Today we are waiting for high-impact economic data issued by the US economy, “US inflation data, producer price index” from England, and we are waiting for “Gross Domestic Product”, and we may witness high volatility at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations