Gold prices (XAU/USD) recorded a sharp decline in the previous session after stronger US inflation data boosted the dollar at the expense of the precious metal, sending prices to a low of $3,329.

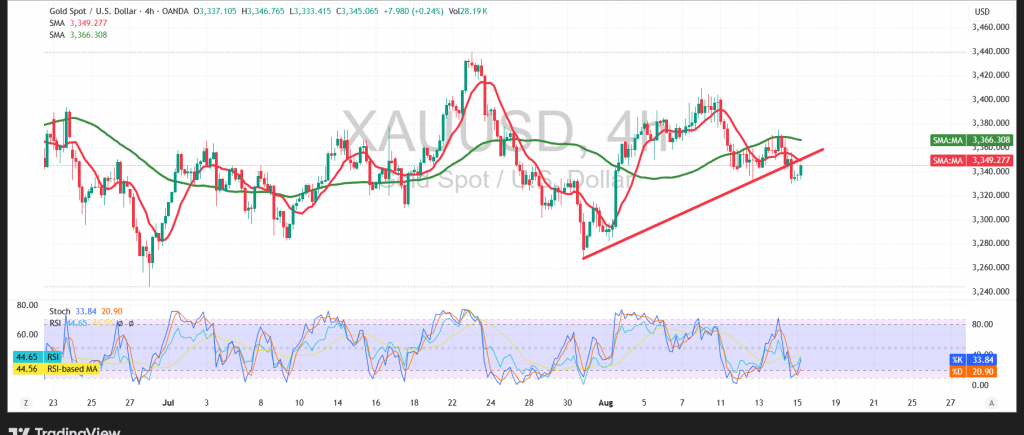

Technical Outlook – 4-hour timeframe:

Intraday price action shows only limited rebound attempts, as the 50-period simple moving average continues to act as a firm resistance barrier against upward moves. The Relative Strength Index (RSI) remains in negative territory despite entering oversold levels, reflecting persistent selling pressure. In addition, the break below a minor ascending trend line on the chart further supports the probability of a continued bearish wave.

Probable Scenario:

The downtrend remains dominant as long as intraday trading stays below the 3,350 resistance level. A decisive break below 3,329 would open the way for losses toward initial support at 3,325, followed by the key support area at 3,304. Conversely, a breach of the 3,350 resistance could trigger a quick recovery attempt toward 3,369 and then 3,374.

Fundamental Note:

Today’s session will feature high-impact US economic releases, including retail sales, preliminary Michigan consumer confidence, and preliminary Michigan inflation expectations. These events could cause notable volatility in gold prices.

Warning: Risks remain high amid ongoing trade and geopolitical tensions, making all scenarios possible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations