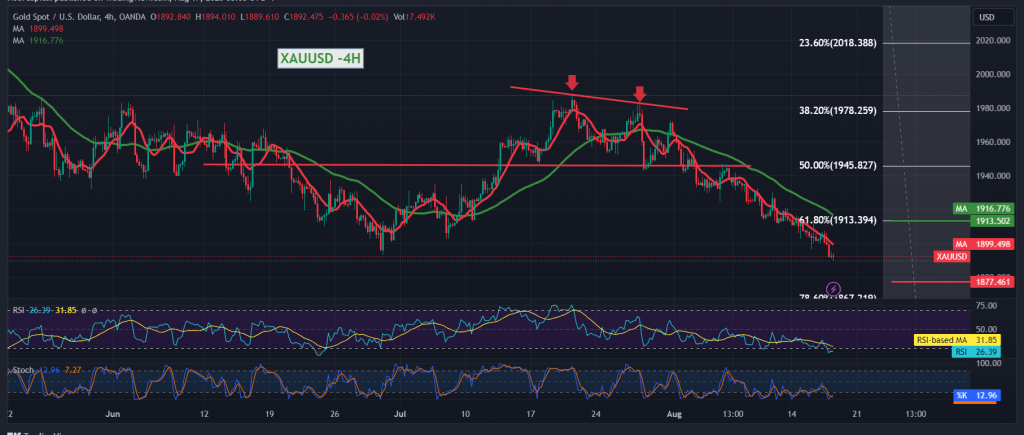

Gold prices continue to decline under pressure, with the US dollar rising. It is heading to touch the official targets required to be achieved during the previous report at 1894 and 1886, to suffice with recording its lowest price at $1886 per ounce.

On the technical side today, by looking at the 4-hour chart, with the continuation of the negative intersection of the simple moving averages, which constitute a solid impediment to gold prices, and continue to exert negative pressure on the price from above, in addition to the continuation of the negative impact of the bearish technical pattern.

From here, with the stability of intraday trading below 1913, the previously broken support, and now converted to the Fibonacci correction resistance level 61.80%, the bearish scenario remains the most favorable during today’s session, continuing towards the rest of the targets of the last report at 1885, and the losses extend towards, knowing that the 1875 level has become a major expected target.

To remind you that the upside move and the price’s consolidation with a 4-hour closing above 1913, that postpones the chances of a decline, and gold prices may witness a temporary recovery with the aim of re-testing 1922 and 1929 before the start of the decline again.

Note: Today we are awaiting high-impact economic data issued by the US economy, “unemployment benefits” and may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations