The prices of the yellow metal suffer from the continued rise of the US dollar, forcing the price to trade again below the $1700 level per ounce, recording $1,661, its lowest price in almost a week.

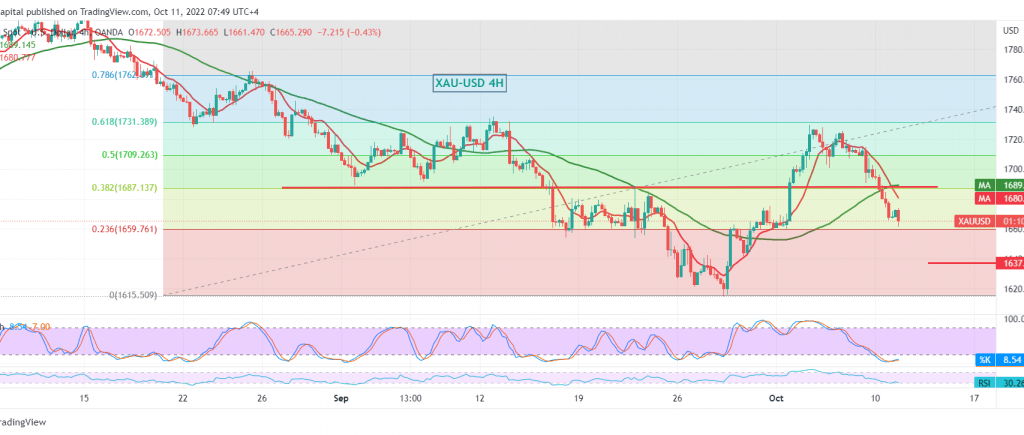

On the technical side today, the simple moving averages still constitute an obstacle to the price, and the negativity triggers the clear negative signs on stochastic in the 240-minute time frame.

With the stability of daily trading below 1681 and the most critical stability below 1690, the resumption of the bearish trend is the most likely during today’s session, and breaking 1659 is a 23.60% correction targeting 1651, taking into account that breaking 1651 facilitates the task required to visit 1637 next official station.

Rising and attempts to consolidate above 1690/1687 may lead gold prices to recover temporarily towards 1700 and 1710.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations