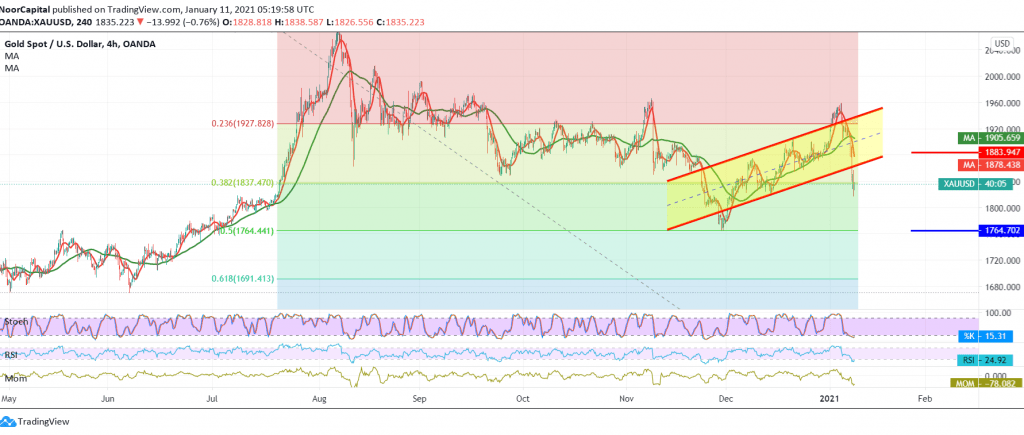

Gold prices incurred heavy losses at the end of last week’s trading within the aforementioned bearish context, in which we relied on confirming the breach of the psychological barrier support level of 1900, surpassing the required target of 1880, to record the lowest at 1817 during early trading for the current session.

Today’s technical outlook indicates a possible continuation of the decline. Looking at the 4-hour chart, we find the price is generally stable below 1880, the previously broken support-into-resistance, and we find an intraday stability below 1837 Fibonacci retracement 23.60%.

From here, trading steadily below 1880 encourages us to maintain our negative expectations targeting 1800 and then 1794, respectively. It should be carefully noted that trading below 1794 increases and confirms the strength of the bearish trend so that we await 1764 Fibonacci 50.0%, a next stop.

The mentioned bearish scenario requires stability below 1880.

Note: Stochastic is trading around oversold areas.

| S1: 1794.00 | R1: 1895.00 |

| S2: 1755.00 | R2: 1955.00 |

| S3: 1695.00 | R3: 1995.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations