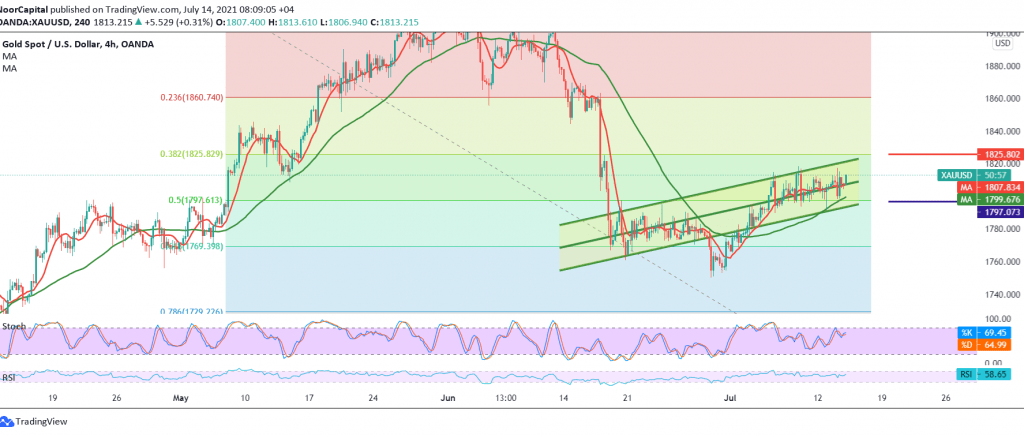

Gold prices successfully retest the pivotal support at 1797, mentioning in the previous analysis that represents the key to protecting the bullish trend, recording its lowest price at 1797; the bullish rebound returns to settle above the strong student area 1800.

Technically, by looking at the 4-hour chart, we find the 50-day moving average continuing to hold the price from below, supporting the ris; thiss comes in conjunction with the stability of the RSI above the mid-line 50. Therefore, with the intraday trading stability above 1800 and above 1797, 50.0% Fibonacci retracement.

The bullish bias is likely today, provided that the price stability breaches above 1820, targeting 1825 initial goal, and its breach is a catalyst that enhances the chances of touching 1830 and 1835, respectively.

The bullish scenario depends mainly on stability above 1797, 50.0% correction, and breaking it will immediately stop any attempts to rise and put the price under strong negative pressure; its initial target is 1780, while its official target is around 1777.

| S1: 1797.00 | R1: 1820.00 |

| S2: 1790.00 | R2: 1825.00 |

| S3: 1781.00 | R3: 1835.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations