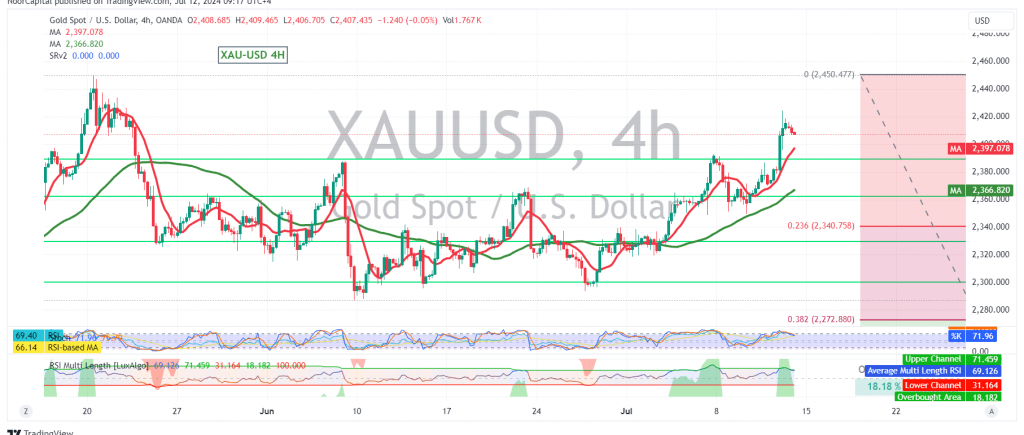

Gold prices have surged significantly, exceeding our previous target of 2400 and reaching a high of $2424 per ounce, confirming the bullish trend we anticipated in our last report.

Technical Outlook:

Gold prices have successfully consolidated above the psychologically significant 2400 level, with the simple moving averages (SMAs) continuing to provide strong support for the upward price movement.

Upward Potential:

With the price firmly above the 2380 support level and the previously breached resistance at 2340 (23.60% Fibonacci retracement) now acting as support, the upward trend is expected to persist. The initial target is 2432, and a break above this level could lead to a challenge of the previous historical peak at 2450. A successful breach of 2450 could propel the price towards a new high around 2485.

Downside Risks:

However, traders should remain cautious as a return of trading stability below 2380 could lead to a temporary correction, targeting 2340.

Key Levels:

- Support: 2380, 2340 (23.60% Fibonacci retracement)

- Resistance: 2432, 2450, 2485

Important Note:

The release of high-impact U.S. economic data today, including monthly producer prices and consumer confidence data, could induce significant price volatility. Traders are advised to closely monitor the market’s reaction to these data releases.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. The risk level remains high in this market, and potential returns may not be proportional to the risks involved.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations