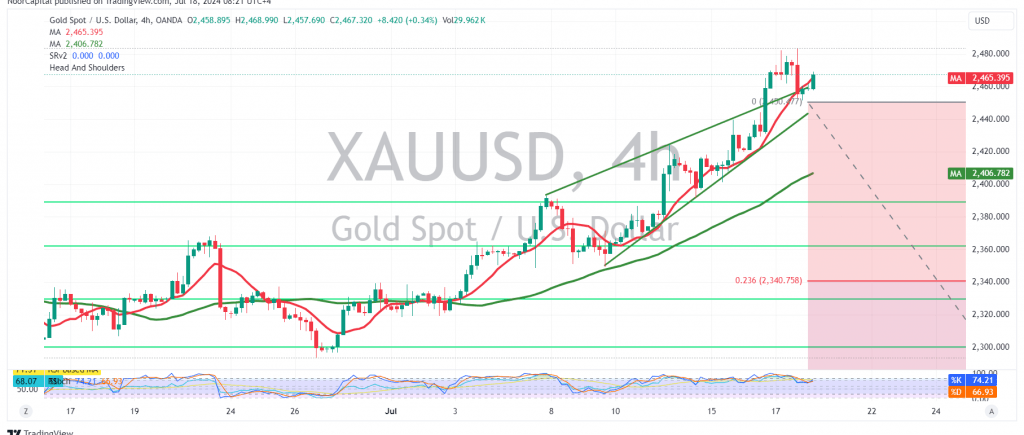

Gold prices reached new historical highs in the previous trading session, surpassing our target of 2450 and reaching a peak of $2483 per ounce, validating our bullish outlook.

Technical Outlook:

The technical outlook remains strongly bullish. The price has successfully consolidated above the previously breached resistance level of 2450, which now serves as a robust support level. The simple moving averages continue to provide strong support, and the Stochastic oscillator is showing signs of further upward momentum.

Upward Potential:

With the current bullish momentum and strong support, we expect the upward trend to persist. Our revised target is 2482, and a break above this level could accelerate the rally towards 2498-2500, potentially extending to 2514.

Downside Risks:

Traders should remain cautious, however, as a return of trading stability and consolidation below 2450 could trigger a temporary correction, targeting 2434 and 2410.

Key Levels:

- Support: 2450, 2434, 2410

- Resistance: 2482, 2498-2500, 2514

Important Note:

The release of high-impact economic data today from the European Central Bank, including the Monetary Policy Committee statement, interest rate decision, and press conference by the President, could induce significant price volatility. Traders should closely monitor the market’s reaction to these data releases.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations