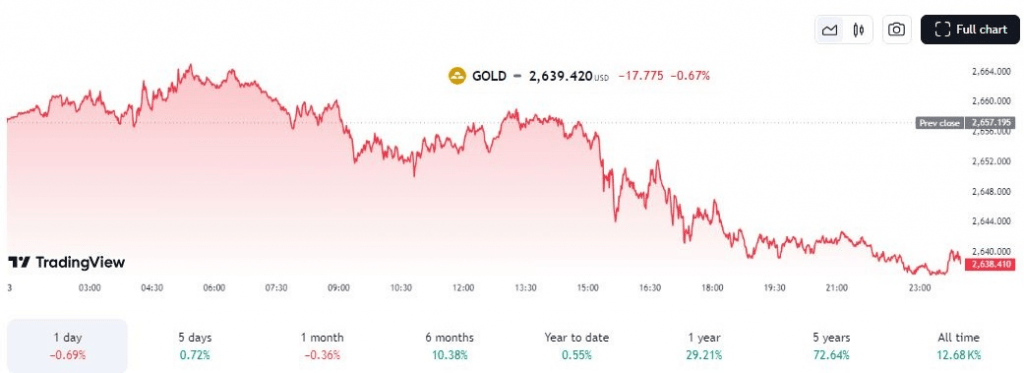

The year 2025 began with a mixed bag for gold investors. After a period of volatility, gold prices dipped on Friday, retreating from earlier gains as market sentiment improved. This shift followed a week marked by conflicting signals, reflecting the intricate interplay of economic data and investor sentiment. Gold is trading -0.67% down, lost -$17.77 per ounce, trading at %2,639.42 at the time of writing. Earlier during Friday’s North American session, gold bids cooled back below $2,650, crimping the week’s gains at the tail end.

The Federal Reserve’s continued assurances of a gradual return to price stability provided a calming influence on the markets. Richmond Fed President Tom Barkin emphasized that the central bank has already taken significant steps to lower interest rates and that inflation is steadily moving back toward the 2% target. Furthermore, Barkin downplayed the potential economic impact of proposed tariffs, stating that the relationship between tariffs and consumer prices is complex and depends on various factors. These statements eased investor concerns and contributed to the improved market sentiment.

Source: TradingView

However, the market remains cautious. The upcoming Nonfarm Payrolls report will be closely watched for further insights into the strength of the labor market. This data will play a crucial role in shaping expectations for future interest rate movements and overall economic growth.

Technical factors: A Range-Bound Struggle

Gold prices have been trapped in a range around $2,650 per ounce in recent weeks, reflecting a period of indecision and uncertainty among investors. The 50-day Exponential Moving Average has acted as a significant resistance level, preventing a sustained breakout and highlighting the challenges faced by gold bulls.

While a recent rally in mining stocks may signal a potential bottom for gold prices, sustained momentum will require a decisive break above key resistance levels. A sustained move above these levels would provide a more convincing bullish signal and could potentially reignite investor interest in gold.

Navigating the Gold Market: A Strategic Approach

The recent price fluctuations underscore the importance of a nuanced and strategic approach to gold investing. As prices fluctuate, investors need to carefully consider their investment objectives and risk tolerance.

Physical Gold: A Tangible Store of Value: As prices rise, physical gold can offer a tangible and reliable store of value. Investing in larger bars can minimize premiums and maximize cost-effectiveness for those seeking direct exposure to the metal.

Timing and Patience: A Virtuous Cycle: The gold market is cyclical. Periods of price volatility can create opportunities for both new and existing investors. Patience and a long-term perspective are crucial for navigating these fluctuations and capitalizing on potential price appreciation.

Diversification: Mitigating Risk: Diversifying your gold holdings across different asset classes can help mitigate risks and optimize returns. This could include investing in gold mining stocks, gold exchange-traded funds (ETFs), or other gold-related instruments.

Gold’s journey in 2024 was remarkable, but the market remains dynamic and unpredictable. As the year unfolds, investors must remain vigilant, adapt to changing market conditions, and carefully consider their investment strategies to navigate the evolving landscape of the gold market.

Gold’s Ascent: Four Catalysts for a $3,000 Breach

Gold has embarked on a remarkable journey, climbing to record highs and exhibiting signs of sustained bullish momentum. While recent price action has seen some consolidation, the underlying factors driving gold’s ascent remain potent, suggesting further gains are likely.

This article will explore four key catalysts that could propel gold prices above the $3,000 per ounce mark in the coming years:

1. Rapidly Increasing Debt and Declining Fiat Currency Value: The United States faces a mounting national debt, exceeding $35 trillion and growing at an alarming rate. This, coupled with a surge in consumer debt across various categories (credit cards, mortgages, auto loans), has fueled a significant expansion of the money supply. While recent efforts to curb inflation have shown some success, the potential for renewed monetary easing and the accelerating de-dollarization trend could further weaken the dollar and drive investors towards gold as a safe haven asset.

2. Robust Gold Demand Fundamentals: Global gold demand remains robust, driven by a confluence of factors. Central banks worldwide are actively increasing their gold reserves, recognizing its strategic importance as a reserve asset. Moreover, investment demand for gold bars and coins continues to grow, reflecting investor concerns about economic and geopolitical uncertainty.

3. Limited Supply Growth: While overall gold supply has increased, this growth is primarily driven by recycling rather than new mine production. Gold mine production has been constrained by rising costs and declining exploration budgets. The number of new gold projects with significant reserves is dwindling, suggesting limited supply growth in the near future. This scarcity dynamic will likely support higher gold prices.

4. Escalating Geopolitical Tensions: The current geopolitical landscape is marked by heightened tensions, with ongoing conflicts and the threat of further escalation. The potential for global instability and the risk of unforeseen events are driving investors towards safe-haven assets, including gold.

The Gold Mining Sector: Outpacing Gold

While gold prices have exhibited strong gains, the gold mining sector has demonstrated even more impressive performance. Gold mining stocks have significantly outpaced gold itself in recent months, reflecting investor optimism about the sector’s prospects.

The confluence of these factors – burgeoning debt, robust demand, constrained supply, and escalating geopolitical tensions – creates a compelling case for continued gold price appreciation. While the path to $3,000 per ounce may not be linear, the underlying fundamentals suggest that gold remains well-positioned for further gains in the years to come.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations