The previous trading session witnessed different movements in gold prices. To remind, we indicated during the previous analysis that activating the selling positions depends on breaking 1880 and this makes it easier to visit 1874 first target and then 1865 next official station to record the lowest price of 1868.

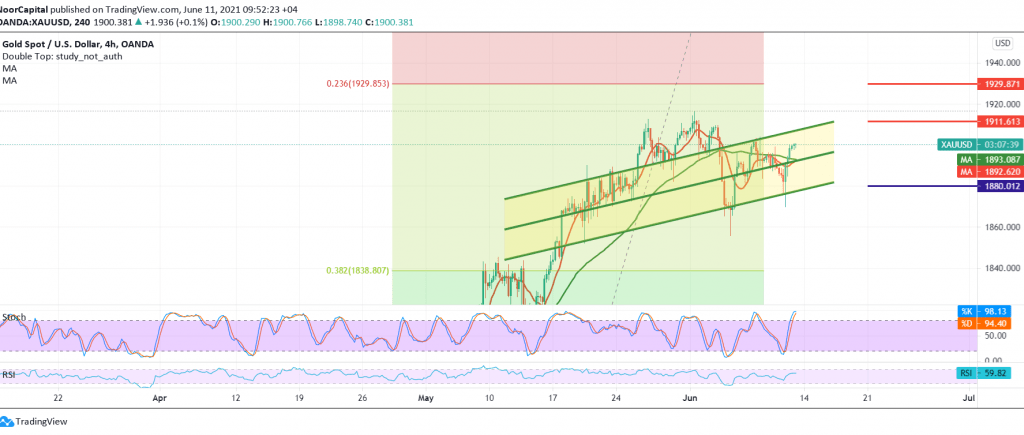

Technically, gold prices resumed trading within the bullish price channel again, supported by the price stability above 1880, in addition to the positive stimulus coming from the 50-day moving average.

Therefore, we tend to be positive, knowing that price stability above 1903, and most importantly 1905, extend gold’s gains so that the way is directly open towards 1911 and 1922, initial targets that may extend later towards 1928, 23.60% correction.

In general, we continue to suggest the bullish trend as long as trading is stable above 1880, and breaking it is capable of thwarting the attempts to rise, and we are witnessing negative trades with its initial target of 1865.

| S1: 1879.00 | R1: 1911.00 |

| S2: 1858.00 | R2: 1922.00 |

| S3: 1847.00 | R3: 1928.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations