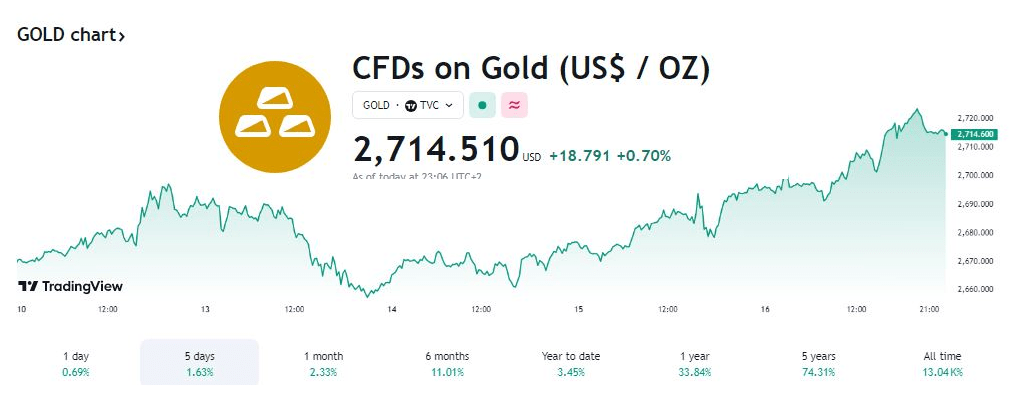

Gold prices surged above the $2,700 mark on Thursday and is trading even above this level, at $2,714 at the timee of writing. This bold price action is certainly fueled by a weaker US Dollar and declining US Treasury yields. This rally comes amidst mixed economic data from the United States.

Source: TradingView

Mixed US Data

While US Retail Sales slightly missed estimates in December, an upward revision to November’s data indicated continued consumer strength. However, a surprise increase in US Initial Jobless Claims weighed on the US Dollar.

Dovish Fed Signals

Fed Governor Christopher Waller’s dovish comments further supported the gold rally. Waller hinted at the possibility of earlier and more aggressive interest rate cuts if disinflationary pressures continue. This sentiment was echoed by Chicago Fed President Austan Goolsbee, who expressed confidence in the labor market’s stabilization.

Falling Yields Boost Gold

Declining US Treasury yields, particularly the 10-year Treasury Inflation-Protected Securities (TIPS) yield, provided a significant tailwind for gold. The falling yields reduced the opportunity cost of holding non-interest-bearing gold.

Technical Factors:

Gold prices have broken above the crucial $2,700 resistance level, indicating strong bullish momentum. The Relative Strength Index (RSI) suggests further upside potential.

Key Resistance Levels

$2,726: December 12 high

$2,750: Next key resistance level

$2,790: All-time high

Potential Support Levels

$2,700: Recent breakout level

$2,656: January 13 swing low

$2,639 – $2,642: Confluence of 50 and 100-day Simple Moving Averages

Gold prices rallied significantly on Thursday, driven by a combination of factors, including a weaker US Dollar, falling Treasury yields, and dovish signals from Federal Reserve officials. While mixed US economic data provided some near-term volatility, the overall trend for gold remains bullish.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations