Gold’s Trajectory Amidst Geopolitical Tensions and FOMC Minutes

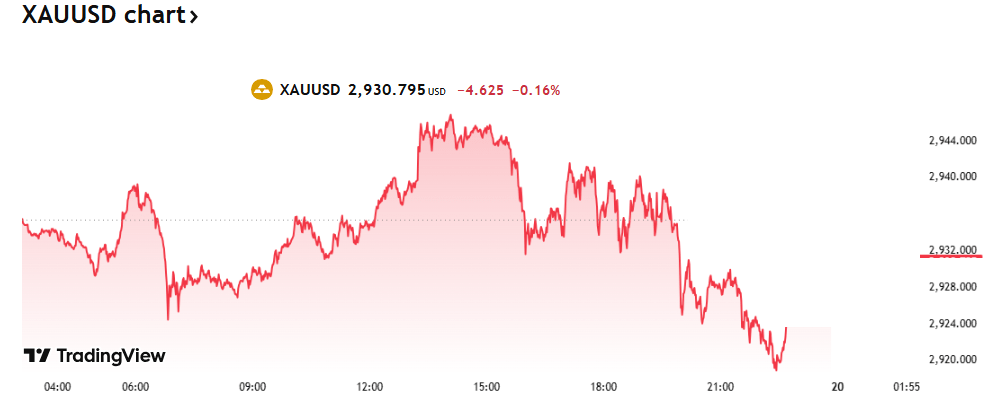

Gold prices have recently retreated from a peak of $2,947.06, reached during European trading hours, but remain elevated above $2,920. This movement occurs against a backdrop of geopolitical uncertainty and anticipation for the release of the Federal Open Market Committee (FOMC) minutes from its January meeting.

Geopolitical Influences on Gold Prices

The recent fluctuations in gold prices coincide with market unease spurred by developments concerning the United States and Russia. Discussions between the two nations regarding the ongoing conflict in Ukraine, coupled with potential trade tensions signaled by the US, have contributed to a shift in market sentiment. These events have triggered concerns among investors, impacting stock markets and strengthening the US Dollar. As a safe-haven asset, gold often sees increased demand during times of uncertainty, explaining its earlier price surge.

FOMC Minutes and Future Monetary Policy

The upcoming release of the FOMC minutes will offer insights into the discussions and considerations behind the Committee’s recent decision to maintain interest rates. The document will be scrutinized for clues regarding the Federal Reserve’s future monetary policy direction. Any indications of a more hawkish stance, suggesting potential rate hikes, could put downward pressure on gold prices, as higher interest rates typically make holding non-yielding assets like gold less attractive. Conversely, if the minutes reveal concerns about economic growth or a more dovish outlook, it could bolster gold’s appeal.

Technical Analysis of Gold’s Price Movement

From a technical perspective, the daily chart indicates that while gold has pulled back from its recent high, the potential for a significant decline appears limited. Technical indicators, although slightly retreating from overbought levels, do not exhibit a strong downward trend. The 20-day Simple Moving Average (SMA), currently around $2,845.00, offers dynamic support.

The 4-hour chart suggests the current pullback is corrective, as gold remains above its key moving averages. The 20 SMA at approximately $2,913.05 provides immediate support, while the 100 and 200 SMAs maintain their upward trajectory. Although technical indicators are trending lower on this timeframe, they remain within positive territory, further mitigating the likelihood of a substantial price drop.

Key support levels are identified at $2,913.05, $2,909.60, and $2,897.10. Resistance levels to watch are $2,947.10, $2,960.00, and $2,975.00.

What’s Next for Gold Prices?

Gold’s price trajectory in the near term will likely be influenced by the information contained within the FOMC minutes and further developments on the geopolitical front. Any escalations in global tensions could reignite safe-haven demand, while a more hawkish Fed stance could dampen investor enthusiasm. The interplay of these factors will determine the direction of gold prices in the coming days and weeks. Regardless of short-term fluctuations, gold’s status as a hedge against uncertainty and inflation suggests it will continue to play a significant role in investment portfolios.

Gold prices surged to a record high of $2,947.06 on Wednesday in European trading, rebounding as market sentiment turned negative due to news surrounding the US President. The President initiated communication with Russia’s President Putin, with the goals of normalizing relations and facilitating a peace accord in Ukraine. However, the President’s assertion that Ukrainian officials are to blame for the ongoing conflict drew a sharp rebuke from Ukrainian President Zelenskyy.

Adding to market anxieties, the US President’s threats of increased tariffs on imports have contributed to a downturn in stock markets, with Wall Street declining after the S&P 500’s record peak on Wednesday. This has led to increased demand for the US dollar. The upcoming release of the Federal Open Market Committee (FOMC) minutes from their January meeting is expected to provide insights into the factors influencing policymakers’ decision to hold interest rates steady and offer clues about future monetary policy.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations