For the third consecutive session, gold prices fail to stabilize above the pivotal resistance level published in the previous analysis, located around 1880/1882, which forced the price to trade negatively again within the bearish context.

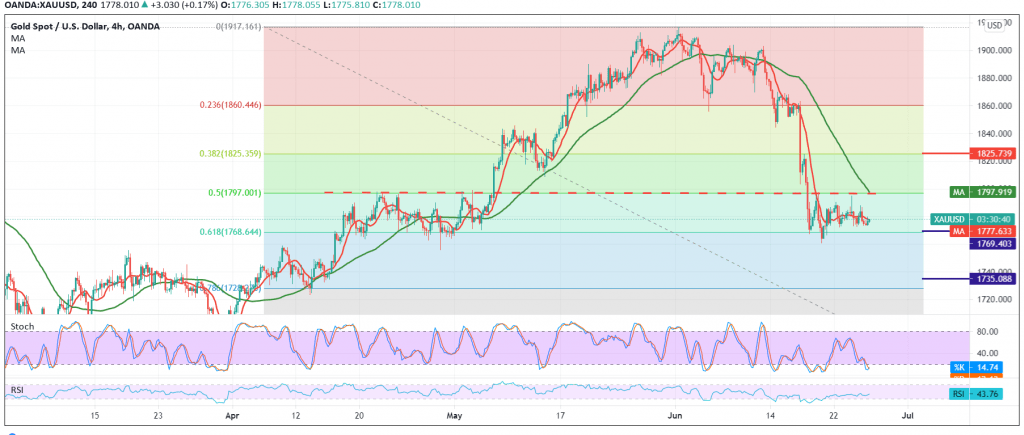

On the technical side, today, and carefully looking at the 240-minute chart, we find the simple moving averages continuing their negative pressure on the price from above, and this comes in conjunction with the RSI receiving negative signals.

From here and steadily trading intraday below 1785/1788 and in general below the pivotal resistance level 1797 represented by 50.0% Fibonacci correction, this encourages us to maintain our negative outlook targeting 1770/1768 correction 61.80%, a first target, and we should pay close attention in case the mentioned level is touched due to the extent Its importance for the general trend in the medium term, and breaking it would extend gold’s losses to be waiting for 1735 official targets for the current downside wave.

From above, a break above 1797/1800 will stop the bearish bias immediately, and we may witness a retest of 1825, 38.20% correction.

| S1: 1770.00 | R1: 1785.00 |

| S2: 1762.00 | R2: 1794.00 |

| S3: 1753.00 | R3: 1801.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations