Gold prices soared by more than 1.93% on Tuesday, fueled by intensifying expectations for a US interest rate cut in September. This sentiment gained momentum following the release of the latest US inflation data, which came in weaker than anticipated.

The attempted assassination of former US President and Republican candidate Donald Trump, although unsuccessful, also played a role. The incident sparked speculation that it could bolster Trump’s popularity and increase his chances of winning the November election.

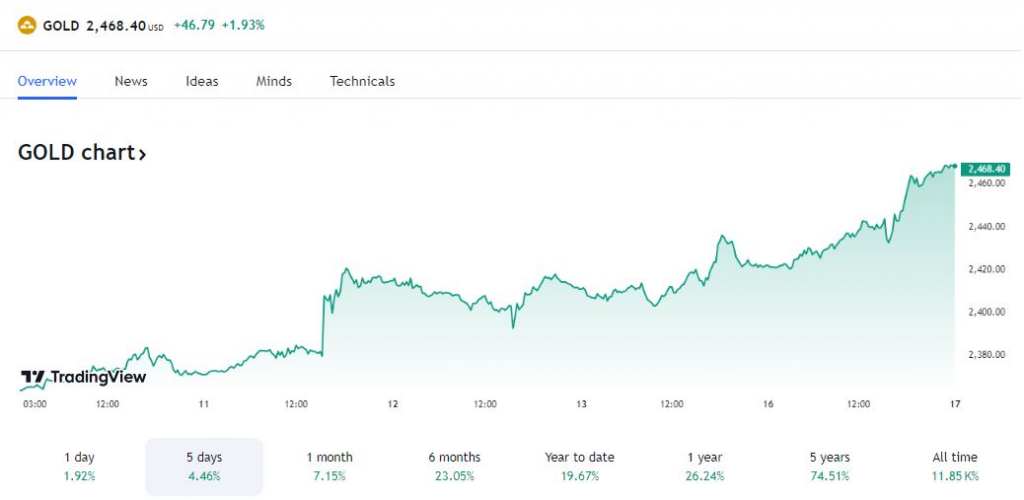

At the time of writing, spot gold contracts reached a record high of $2,468.40 per ounce, compared to the previous close of $2,421 in North America. The intraday range saw a low of $2,420 and a high of $2,468.85.

Lower US Inflation Fuels Rate Cut Bets

The US Consumer Price Index (CPI) for June surprised markets by falling 0.1% compared to the previous month’s flat reading. The annual inflation rate also came in lower than expected, at 3.00% year-on-year compared to a forecast of 3.1%. Excluding food and energy, the core CPI ticked up slightly by 0.1% month-on-month, but remained below the anticipated 0.2%. The annual core CPI also decreased to 3.3%, surpassing analyst predictions for a flat reading.

Retail Sales Slump Adds to Rate Cut Pressure

Fresh data released on Tuesday revealed a decline in US retail sales for June, aligning with market expectations for softening consumer spending and potentially lower prices down the line. Compared to the prior month’s 0.3% increase, retail sales dipped to zero growth in June.

Technical Indicators Point to Continued Strength

Recent price action and a monthly bullish signal triggered in early July, after gold surpassed its June high of $2,388, suggest further upside potential. With July past its midpoint, there’s a chance for gold to finish the month strong, trading in the upper third of its monthly range. Analysts also point to a recently confirmed weekly bullish continuation signal, increasing the likelihood of gold closing the week strong in the upper portion of its weekly range. This momentum could translate into further gains in the following week.

Positive Outlook for Gold Prices

The record highs achieved on Tuesday underscore the optimistic outlook for gold prices. Analysts anticipate long-term growth for the precious metal, mirroring the broader trend across stocks and bonds. This is largely driven by the Federal Reserve’s anticipated interest rate cut, a move intended to combat declining inflation.

A potential rate cut by the Fed later this year would weaken the US dollar and Treasury yields, making gold a more attractive investment, particularly as a safe-haven asset. Weaker-than-expected economic data coupled with the recent surprise drop in US inflation are putting downward pressure on bond yields, further enhancing the appeal of low- and non-interest-yielding assets like gold.

Yields, Dollar Down, Gold ETFs Up

Tuesday’s trading session saw the yield on 10-year Treasury notes fall to 4.179% from 4.231% the previous day. The ICE US Dollar Index (DXY) edged up slightly by 0.1% to 104.34 but remained down 1.4% for the month.

The recent surge in gold prices can be undeniably attributed, at least in part, to a weaker dollar and lower bond yields. These developments, fueled by weaker US data and the unexpected 3% decline in US consumer inflation last week, have further amplified the appeal of low- or non-interest-yielding assets like gold.

SPDR Gold Trust Reaches New Peak

The SPDR Gold Trust (GLD), a gold exchange-traded fund (ETF), reached a new all-time high on Tuesday, surpassing its previous record set in November 2004. The GLD climbed 1.8% to $227.87 in Tuesday’s trading, after reaching an intraday high of $227.98.

While gold ETF holdings peaked in October 2020 and have since fallen by 26%, they appear to have bottomed out in May 2024. A renewed wave of demand, particularly from investment advisors and financial institutions, seems to be driving the recent increase in holdings across these funds.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations