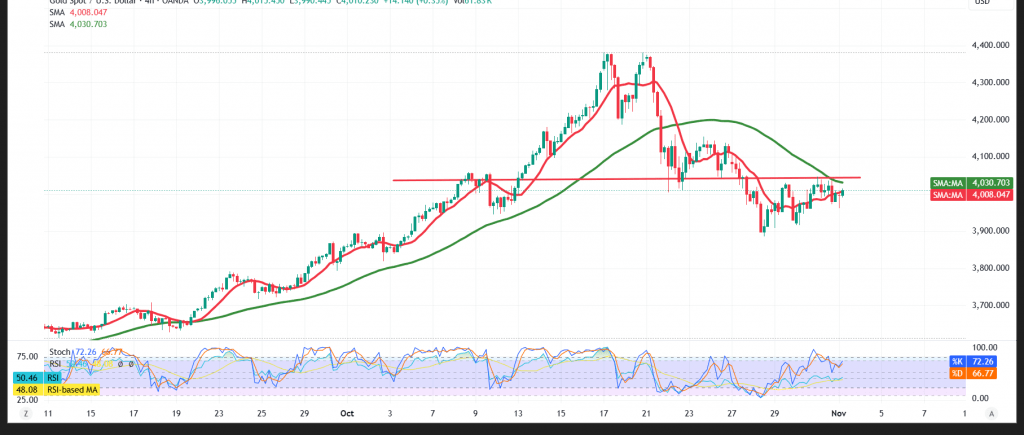

Selling pressure persists within the ongoing corrective downswing, with price printing a $3,962 low in the prior session.

Technical outlook

- Trend & SMAs: The 4H simple moving averages slope lower and cap rebounds as dynamic resistance—consistent with a bearish structure.

- Structure: A prior rising trendline break keeps downside risk in focus.

- Momentum: RSI upticks are unconvincing (overbought relative to weak price bounces), suggesting limited follow-through on rallies.

Base case (bearish while below $4,020 / $4,045)

- Holding below $4,020—and more decisively below $4,045—keeps the corrective downtrend favored.

- A break/4H close beneath $3,962 would likely extend losses toward $3,920 initially.

Invalidation / upside toggle

- A sustained 1H close back above $4,045 would signal a recovery attempt, with scope for $4,085.

Risk note

Gold’s risk profile is elevated and may not suit all investors. Consider prudent sizing, hard stops, and be ready to reassess quickly if these key levels give way amid ongoing trade and geopolitical headlines.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 3962.00 | R1: 4046.00 |

| S2: 3920.00 | R2: 4088.00 |

| S3: 3878.00 | R3: 4130.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations