We adhered to intraday neutrality during the previous technical report due to the conflicting technical signals and the confinement of trading within a sideways range, explaining that activating the selling positions requires a break of 1913 for the price to head to touch the target of the first break at 1908, recording its lowest level at $1907.00 per ounce.

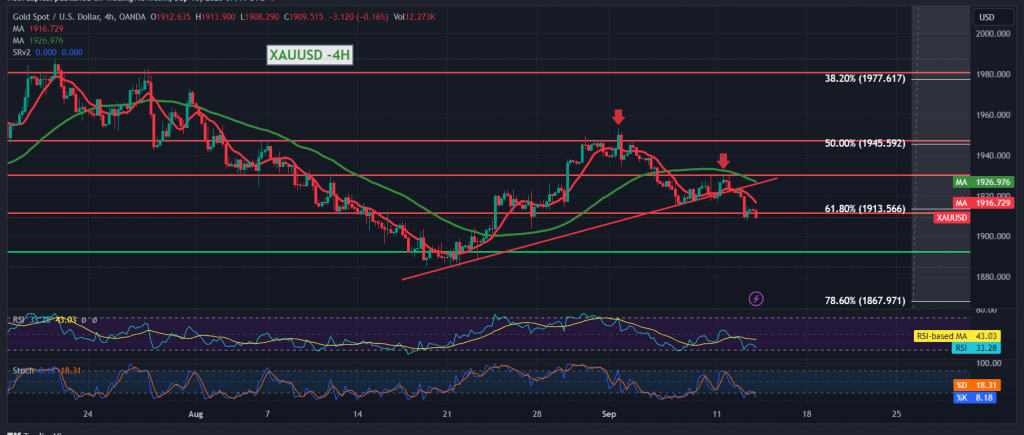

Technically, today the intraday movements are witnessing stability below the 1913 support level represented by the 61.80% Fibonacci retracement as shown on the 4-hour chart, and we also find the simple moving averages have returned to pressure the price from above.

From here, with stable trading below 1920 and in general below the main resistance of 1929, the downward trend is the most preferred during the day, continuing towards the second target of the previous report, 1902, knowing that sneaking below the aforementioned level increases and accelerates the strength of the downward trend, so we are waiting for 1896, the next official station that may extend later to 1885.

We remind you that price consolidation and stability above 1929 can thwart the downward trend immediately, and gold recovers directly to the visits of 1935 and 1945, the 50.0% correction, respectively.

Note: Today we are awaiting the monthly and annual US inflation data, the “Consumer Price Index,” and we may witness high price fluctuations when the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations