Gold prices showed mixed performance during the previous session, largely aligning with the anticipated downward corrective trend outlined in the prior technical report. The bearish scenario was initially supported by trading remaining below the $3,325 resistance level. However, as cautioned, any attempt to break above $3,325–$3,331 would invalidate that outlook. Indeed, gold rebounded to reach $3,349 per ounce, temporarily recovering and offsetting part of the short positioning.

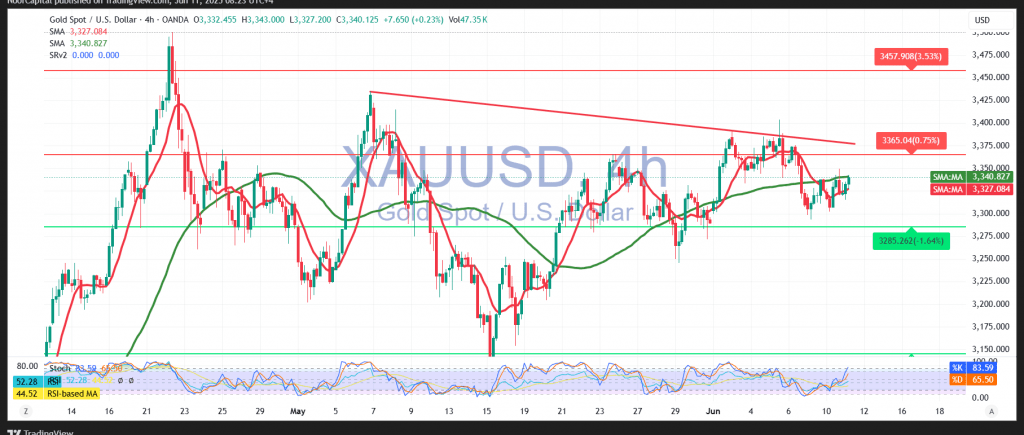

From a technical perspective today, the 4-hour chart indicates that downward pressure remains intact. The simple moving averages continue to act as dynamic resistance, and bearish signals on the Relative Strength Index (RSI) persist—suggesting fading bullish momentum and increased selling pressure.

We maintain a cautious bearish bias, with a break below $3,330 likely accelerating the decline toward the next support at $3,312. A confirmed breach below this level would further confirm the continuation of the corrective downtrend, with $3,282 as the next downside target.

However, a breakout above $3,350 could interrupt this scenario. In such a case, gold may attempt to reclaim higher territory, with short-term resistance levels seen at $3,360 and $3,368.

Market Risk Warning:

Today’s release of the U.S. monthly and annual Core CPI is highly anticipated and could trigger sharp price swings across the market, including in precious metals.

Caution: Amid ongoing global trade tensions and economic uncertainty, market risk remains elevated, and all scenarios should be considered. Use prudent risk management.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations