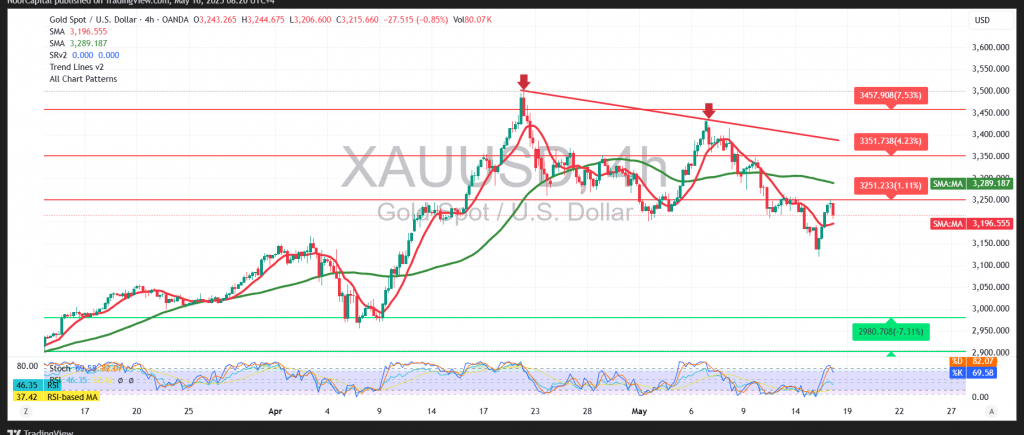

Gold prices declined sharply in the previous session, pressured by profit-taking after strong gains earlier in the year. The market reached key downside targets outlined in the previous report, with prices falling Gold prices saw mixed trading in the previous session, briefly approaching the first downside target at $3,112 before finding support near $3,120. During the mid-session, the metal staged a modest bullish rebound, breaking above the $3,220 resistance and reaching an intraday high of $3,252 per ounce.

Despite this recovery, the broader technical structure remains corrective. Price action continues to respect a descending trendline and stays below the 50-period simple moving average—both reinforcing the prevailing bearish momentum. Meanwhile, the Relative Strength Index (RSI) is hovering near overbought territory, indicating limited potential for sustained upside in the near term.

As long as daily trading remains below the $3,260 resistance level, the outlook favors a continuation of the corrective downtrend. A confirmed move below $3,200 would likely intensify selling pressure, with downside targets at $3,138 and $3,120. A breach of $3,120 could accelerate the decline, exposing gold to a potential drop toward the $3,070 level in the short term.

Conversely, a confirmed daily close above $3,270 would challenge the bearish scenario, opening the door for a stronger rebound. In that case, gold could target resistance at $3,300, with further upside potential toward $3,327.

Risk Disclaimer:

Amid ongoing global trade tensions and macroeconomic uncertainties, market volatility remains high. Traders are advised to exercise caution and prepare for sharp price movements in either direction.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations