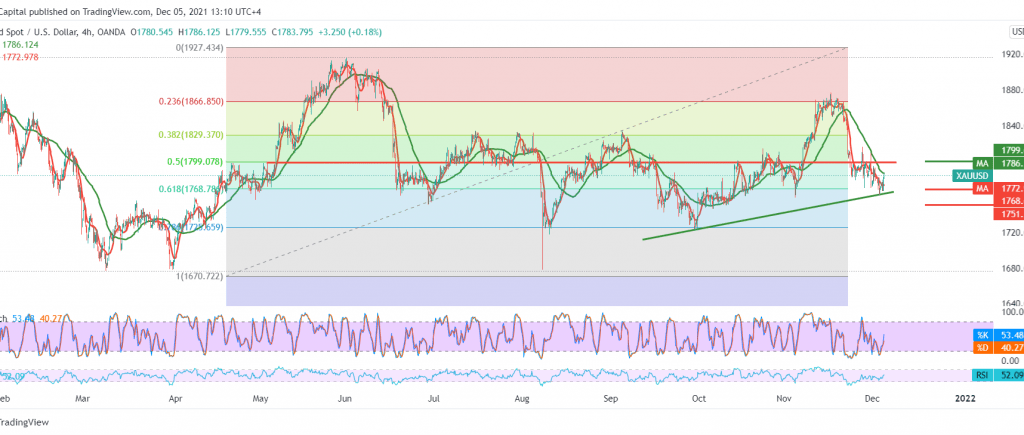

The yellow metal showed positive movements supported by the decline of the US dollar after the US employment data, to record its highest level at 1786, after recording the lowest around the strong demand area at 1761.

Technically, trading stability is above 1768, 61.80% Fibonacci correction, as shown on the chart, which is the key to protecting the short bullish trend. This factor supports the rise and the momentum indicator getting positive signs.

Therefore, we may witness a bullish tendency in the coming hours to retest 1792, a first target, and then 1799 50.0% Fibonacci retracement, representing one of the keys to the short trend.

Declining below the 1768 support level will stop the intraday rise attempts and lead gold to complete the descending path with the target of 1758/1761, considering that breaking the latter can extend the losses towards 1751.

| S1: 1768.00 | R1: 1792.00 |

| S2: 1751.00 | R2: 1801.00 |

| S3: 1742.00 | R3: 1817.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations